Citizenship by investment and having a second passport are becoming more attractive in today’s interconnected world. Countries around the globe are rolling out the red carpet for affluent families and investors, presenting programs that welcome your investment and reward it with the priceless asset of citizenship or residency. At first glance, unlocking the door to global citizenship through real estate investment seems the most attractive option (versus a cash donation). This innovative path allows you to secure second citizenship by investing in property, offering a unique blend of financial freedom and the luxury of global mobility. However, most investors struggle to find value in citizenship by investment approved properties in the Caribbean, Europe, and beyond.

The comprehensive guide explores the challenges investors often face, such as finding the ideal program that balances cost, benefits, and requirements and navigating the often complex legal and bureaucratic landscape involved in such investments. We also delve into the attractive citizenship by investment programs, highlighting those offering the best combination of ease, benefits, and investment opportunities.

Understanding Citizenship by Real Estate Investment

Exploring citizenship through real estate investment broadens your perspective on financial freedom and global mobility. This innovative approach secures a tangible asset and opens up numerous opportunities to live, work, and travel internationally. By investing in property overseas, you diversify your investment portfolio and gain access to a lifestyle of international luxury and convenience, offering profound personal and professional freedom.

Key Benefits and Processes

At the core, citizenship by real estate investment programs offers a dual advantage: a profitable investment in property and a potential passport and/or residency in the country of investment. Countries like Dominica, Antigua, and Grenada have become popular for their transparent and efficient citizenship by investment programs. Investing in real estate within these jurisdictions can not just a vacation home but also a chance to become part of a global community.

Investment Thresholds and Criteria

Each country sets its minimum investment criteria to qualify for citizenship. For instance, the investment requirement may range from $200,000 in Dominica to $400,000 in Antigua and Barbuda, each with its own set of benefits and obligations. Understanding these thresholds is crucial as they directly impact your eligibility and the benefits you can reap from your investment.

The Application Process

Navigating the application process for citizenship by investment in real estate involves several steps, from selecting a qualifying property to fulfilling legal and financial requirements. The process generally includes due diligence checks to ensure the integrity and security of the program for all parties involved. Understanding each step, timeline, and requirement is essential for a smooth application process.

By diving deep into citizenship by real estate investment, you unlock not just a door to global mobility but also an investment that could appreciate over time. It’s an attractive proposition for those looking to broaden their lifestyle options and financial portfolio on a global scale.

Key Advantages for Investors

Investing in real estate opens the door to a lucrative asset and paves the way for obtaining citizenship in a new country. Such investments come with many benefits, ranging from wealth diversification to enhanced global mobility. In this section, we’ll deep-dive into the key advantages that citizenship through real estate investment can offer to investors.

Wealth and Portfolio Diversification

Diversifying your investment portfolio is crucial for minimizing risk, and real estate investment in foreign countries offers a unique opportunity to achieve this. Investing in properties in countries like Dominica, Antigua, and Grenada means acquiring assets in different geographical locations and ensuring that your investment is resilient against economic fluctuations in your home country. Citizenship by investment real estate programs offer tangible assets that have the potential to appreciate over time, providing financial security and returns on your investment.

Visa-Free Travel Access

One of the most coveted benefits of citizenship by real estate investment is visa-free or visa-on-arrival access to numerous countries. Nations like Dominica, Antigua, and Grenada boast strong passports that allow visa-free entry to over 100 countries, including the Schengen Area, the UK, and many others. This enhanced global mobility can be a game-changer for investors, offering ease of travel for business, pleasure, or even accessing international markets more efficiently.

Potential Tax Advantages

Investing in real estate with the aim of citizenship can also open up potential tax advantages. Certain countries have favourable tax regimes for foreign investors, including no tax on worldwide income, capital gains, gifts, wealth, and inheritance. This can significantly reduce your tax burden, especially if you want to legally manage or mitigate taxes in your home country. However, consulting with a tax advisor is important to understand the tax implications based on your circumstances fully.

Right to Live and Work in a Country and Region

Gaining citizenship through real estate investment grants you the right to reside in the country of investment and offers broader regional mobility and work opportunities. For instance, acquiring citizenship in a member country of the Caribbean Community (CARICOM) allows you the freedom to live, work, and travel within the member states. This opens up a new realm of personal and professional possibilities, from accessing emerging markets to enjoying a lifestyle change in idyllic settings.

Bragging Rights

While it may not be the primary motivation for most investors, there’s no denying the prestige of holding dual citizenship, especially one acquired through strategic investment. It reflects financial acumen and global-mindedness, laying the groundwork for exclusive networking opportunities with like-minded individuals. Moreover, property ownership in exotic locales can be a source of pride and a testament to one’s investment savvy and worldliness.

Citizenship by real estate investment offers a unique blend of financial gains, personal freedom, and global connectivity, making it an attractive option for investors looking to broaden their horizons and secure their family’s future.

Evaluating Citizenship by Real Estate Investment Programs

When considering citizenship through real estate investment programs, you’re making a transformative decision that involves significant financial commitments and strategic planning. Understanding the key factors for selecting the right country and real estate project is paramount to navigating this landscape effectively. Each step in this process requires meticulous evaluation to ensure the benefits align with your personal and financial goals.

Criteria for Selecting the Right Country

The choice of country is the first and perhaps the most critical step in the citizenship by real estate investment journey. Factors such as geopolitical stability, quality of life, visa-free travel access, and economic resilience play pivotal roles in this decision. For instance, countries like Dominica, Antigua, and Grenada are popular for their citizenship by investment real estate programs due to their stable political climates, global mobility perks, and investment-friendly environments.

Additionally, consider the Global Passport Index ranking to indicate the strength of the citizenship you’re acquiring. A higher ranking often signifies broader visa-free travel opportunities, enhancing personal and business flexibility across the globe.

Choosing the Right Real Estate Project and Developer

Once you’ve pinned down your desired country, identifying the right real estate project and developer is your next vital step. You must ensure the project’s legitimacy, financial health, and the developer’s track record for delivering on promises. Investigating previous projects completed by the developer and reviews from current investors provides insight into their reliability and the potential success of your investment.

Furthermore, your choice should reflect not just financial returns but also your lifestyle preferences. Whether it’s beachfront villas in Grenada or mountain retreats in Dominica, the property should meet your aspirations for a second home or an investment property.

Cost and Economic Considerations

Understanding the full spectrum of costs involved in citizenship by real estate investment is crucial. This includes not just the investment threshold, but also additional fees such as processing, due diligence, and legal fees. Countries like Antigua and Dominica offer programs with different investment thresholds, catering to a range of financial capabilities.

Evaluating the economic environment of the host country is equally important. You need to consider the real estate market’s stability, property appreciation potential, and rental yield prospects to make an informed decision about where your investment can flourish.

Legal and Residency Requirements

Legal and residency stipulations vary significantly across countries offering citizenship by investment programs. Some nations require a physical presence or a minimum stay, while others, like Portugal’s residency program, require only a minimal stay period. Familiarize yourself with these requirements, as they will impact your lifestyle and mobility.

Moreover, navigating the legal landscape necessitates understanding the pathway from purchasing real estate to obtaining citizenship. Each country has its set of legal frameworks governing the acquisition of property by foreigners, the naturalization process, and the eventual issuance of citizenship. Partnering with a reputable legal advisor familiar with the intricacies of citizenship by investment real estate programs can streamline this process, ensuring compliance and securing your investment and new citizenship effectively.

Embarking on a citizenship by real estate investment requires thorough research and planning. By carefully evaluating the country, the real estate project and developer, underlying costs, and legal requirements, you’ll position yourself to make a decision that aligns with your objectives, securing not just a second home but also a wealth of global opportunities.

Caribbean Citizenship by Investment Real Estate

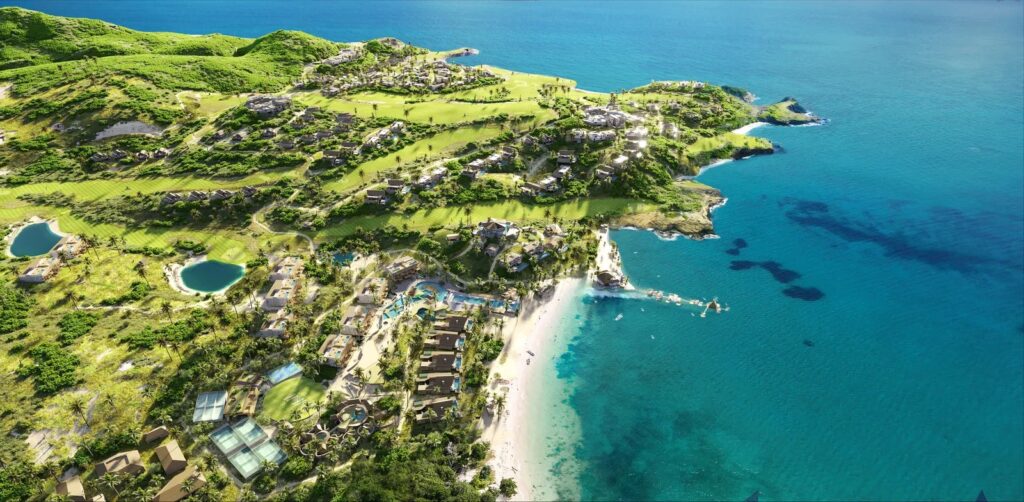

The allure of Caribbean citizenship by investment programs lies not just in their ability to offer a gateway to global mobility and financial flexibility but also in the investment opportunities they present in some of the world’s most breath-taking locales. When you invest in Caribbean real estate, you’re not only securing a path to citizenship; you’re diving into a market ripe with potential, set against the backdrop of the region’s vibrant culture and natural beauty. Below, explore the real estate investment opportunities that can pave the way for citizenship in iconic Caribbean nations.

St. Lucia Real Estate

St. Lucia’s real estate citizenship program stands out for its accessibility and the stunning properties on offer. With a minimum investment of $200,000 in pre-approved government real estate projects, this option covers not only you but also your spouse and financially dependent children. Luxury real estate development in St. Lucia, characterized by serene Caribbean shores or picturesque Atlantic vistas, requires a minimum five-year property retention period. Eligible dependants extend to children and parents with no age limit, including those who are mentally or physically challenged. Processing times average at 7-8 months, making St. Lucia’s program affordable and efficient for investors seeking Caribbean citizenship.

Antigua and Barbuda Real Estate

Antigua and Barbuda offer the perfect blend of investment opportunity and idyllic living. For a minimum investment of $200,000 in approved real estate projects, you can embark on a journey to Antigua citizenship by investment real estate, which is particularly advantageous if you’re bringing your family along. The program offers several investment pathways, including real estate, the National Development Fund (NDF), the University of West Indies Fund (UWIF), and business investment. Opting for real estate investment also means enjoying Antigua and Barbuda’s world-renowned beaches, vibrant culture, and welcoming community.

St. Kitts and Nevis Real Estate

St. Kitts and Nevis run the world’s longest-standing citizenship by investment program, with a strong reputation for stability and due diligence. Real estate investment begins at $400,000 for joint investors or $800,000 for sole ownership in pre-approved commercial properties. Alternatively, a donation of $250,000 to the Sustainable Island State Contribution Fund offers another pathway to citizenship. This dual-island nation not only offers a robust investment environment but also guarantees a lifestyle marked by natural beauty and tranquility.

Grenada Real Estate

While Grenada’s specific citizenship by investment real estate options weren’t detailed in the provided context, it’s known for offering avenues similar to its Caribbean counterparts. Investments typically revolve around luxury resorts and real estate developments approved by the government. Grenada is unique for its visa-free access to China and its eligibility for the USA E-2 visa treaty, making it an attractive option for investors seeking global mobility.

Dominica

Dominica’s citizenship by investment program allows for real estate investment starting at $200,000 in government-approved projects or a $100,000 donation to the Economic Diversification Fund (EDF). Known as the “Nature Island” for its lush landscapes and natural hot springs, Dominica offers investors the chance to contribute to eco-friendly developments while gaining citizenship in a country committed to sustainability and ecological preservation.

Real estate investment in the Caribbean opens doors to a life of security, mobility, and serene beauty, providing a sound investment in both your family’s future and the vibrant market of the islands. With each country offering its unique benefits, your investment goes beyond just acquiring property—it’s an investment in a lifestyle and a future filled with global possibilities.

Choosing the Right CBI Approved Development in the Caribbean

Investing in Caribbean Citizenship by Investment (CBI) projects offers enticing prospects due to the region’s stunning natural beauty. However, the decision to invest must be made cautiously, as the landscape is dotted with as many incomplete projects as successful ones. Here are essential guidelines to help you choose a reliable and successful CBI development:

1. Importance of Location

Location remains a cornerstone of real estate investment, and this principle is no less true for CBI projects. A strategic location not only ensures the attractiveness of the investment but also significantly affects its operational success. Ideal locations cater to the primary market’s demands, such as proximity to swimmable beaches, tourist attractions, and accessibility. Projects not favourably located may struggle to generate sustainable revenue, reducing their viability as an investment.

2. Developer Commitment and Financial Health

Evaluating the developer’s commitment to the project is crucial. The amount of equity the developer invests is a strong indicator of a project’s potential for success. Projects heavily reliant on CBI funds with little capital investment from the developer can often lead to mismanagement or abandonment. An adequately capitalized project, where the developer has a significant financial stake, generally indicates a higher level of commitment and confidence in the project’s success.

3. Land Ownership Verification

Secure land ownership is a critical factor that can make or break a project. Investors must ensure that the land for the CBI project is owned outright (freehold) or held on a long-term leasehold by the developer. Properly registered and uncontested land titles provide a solid foundation for the project, ensuring it is free from potential legal disputes that could impede development.

5. Validate Planning Approvals and Project Substantiation

Potential investors should insist on reviewing the final planning approvals issued by local authorities. This step is vital to verify that the project is recognized legally and that its construction is set to proceed according to officially sanctioned plans. Transparency in project planning and approval processes guards against investing in ventures that exist only on paper. Real, actionable plans that have passed regulatory muster are less likely to fail due to non-compliance with local construction and environmental standards.

Conclusion

Choosing the right CBI development in the Caribbean requires a balanced approach of enthusiasm and meticulous scrutiny. The attractiveness of the region’s offerings must be weighed against the practicalities of investment and development risks. By focusing on these key areas—location, developer commitment, land ownership, and verifiable project approvals—you can significantly enhance your chances of investing in a project that promises and delivers long-term value and success.

European Golden Visa Real Estate Opportunities

The allure of obtaining citizenship or residency in Europe through real estate investment has grown significantly, driven by the promise of visa-free travel, quality of life, and access to top-tier education systems. Several European countries offer so-called Golden Visa programs, each with its unique attractions and requirements. Here’s a concise overview of what Cyprus, Greece, Malta, and Spain offer in this realm.

Greece

Greece offers the most affordable entry into European residency through its Golden Visa program. With a minimum real estate investment of €250,000, you can obtain a five-year residency permit for you and your family. This permit allows you to travel freely within the Schengen Zone and, unlike other programs, can be renewed indefinitely as long as the investment is maintained. Additionally, after seven years of uninterrupted residency, you may apply for Greek citizenship. The Greek real estate market offers a wide range of investment opportunities, from historic homes in Athens to stunning beachfront properties, making it an attractive option for many investors.

Malta

While not directly tied to a real estate investment, the Malta Permanent Residence Program (MPRP) provides an alternative route to residency with the potential for real estate investment as part of the process. A significant non-refundable contribution to the national development fund and an investment in real estate or a rental agreement are required. The MPRP guarantees residency rights, including free movement within the Schengen Area. Malta’s appeal lies in its robust economy, Mediterranean lifestyle, and English-speaking populace, making it a highly desirable destination for investors.

Cyprus

Cyprus is one of the most strategic locations for investors looking to gain access to Europe. The Cyprus Permanent Residence Program requires a minimum real estate investment of €300,000 (approximately $329,000). This investment grants you residency and opens the door to an expedited pathway towards citizenship in as little as 3 years, should you meet all the necessary criteria. Key benefits include the right to live in Cyprus, a high standard of living, and visa-free access to numerous countries. Plus, living in Cyprus is not required to maintain your residency status, making it an ideal option for investors seeking flexibility.

Investing in real estate through the European Golden Visa program not only presents an opportunity to diversify your investment portfolio but also offers a gateway to a life in Europe filled with cultural richness, economic stability, and a high standard of living. Each country’s program has its advantages, tailored to meet the needs of investors from around the globe.

Programs Beyond Europe and the Caribbean

Exploring citizenship by real estate investment extends far beyond the shores of Europe and the Caribbean. Countries like Turkey, the United Arab Emirates, Panama, the Cayman Islands, and the Dominican Republic offer unique pathways to citizenship or residency through investment in real estate. These programs provide a variety of benefits, from visa-free travel to business opportunities in strategic locations around the globe. Here’s a closer look at what each country offers.

Turkey Citizenship by Investment

Turkey’s Citizenship by Investment program stands out for its straightforward pathway to citizenship through real estate investment. Investing a minimum of USD 400,000 in Turkish real estate not only opens the door to citizenship but also to a wealth of opportunities in a country that straddles two continents. Turkey’s real estate market is vibrant, bolstered by its dynamic culture, strategic location, and a strong economy. Turkey’s E-2 treaty with the US potentially allows citizens to apply for a US investor visa, further enhancing the program’s attractiveness.

United Arab Emirates Golden Visa

The United Arab Emirates offers the Golden Visa, providing long-term residency to investors. While not direct citizenship, the Golden Visa allows you to live, work, and study in the UAE with the benefit of 100% ownership of your business on the UAE’s mainland. Real estate investors who inject a minimum of AED 2 million into property can secure this long-term residency, enjoying the perks of life in a country known for its luxury, innovation, and strategic business advantages. This program is ideal for high-net-worth individuals looking to expand their real estate portfolio into the Middle Eastern market.

Panama Investor Visa

Panama’s Investor Visa program offers a gateway to residency through various investment options, including real estate. By investing a minimum of USD 300,000 in Panamanian real estate, investors can obtain residency and eventually apply for citizenship. Panama’s strategic location as a global business hub and its use of the US dollar as legal tender make it an appealing option for investors. Furthermore, Panama offers a high quality of life, with access to world-class healthcare, education, and a warm tropical climate.

Cayman Islands Residency

Investing in real estate in the Cayman Islands not only secures a luxurious lifestyle but can also lead to permanent residency. The Cayman Islands do not offer direct citizenship by investment, but investors can apply for residency certificates by purchasing property, allowing them to live on the islands. The minimum investment varies based on the type of residency applied for, with options starting at around USD 1.2 million. Known for its stunning beaches, financial secrecy, and tax-neutral status, the Cayman Islands attract a global elite seeking privacy and tranquillity.

Each of these programs offers a unique set of advantages, catering to different needs and investment styles. Whether you’re seeking a strategic investment opportunity, a luxurious lifestyle, or a pathway to global mobility, these nations provide compelling options beyond the traditional choices in Europe and the Caribbean.

Investment Strategies and Considerations

Embarking on acquiring citizenship through real estate investment requires careful thought and strategic planning. By choosing to invest in properties overseas, you’re not only diversifying your portfolio but also opening up a new realm of opportunities for global mobility and financial growth. This section delves into the crucial aspects of understanding market dynamics and assessing risks to ensure long-term success in your investment.

Understanding the Real Estate Market Dynamics

Grasping the nuances of the real estate market in your country of interest is paramount. For countries like Dominica, Antigua, Grenada, Cyprus, Greece, Malta, Spain, Turkey, the United Arab Emirates, Panama, the Cayman Islands, and the Dominican Republic each presents unique market characteristics. For instance, Dominica’s citizenship by investment real estate market is known for its eco-luxury properties, which appeal to investors looking for sustainable and environmentally friendly options. Similarly, Antigua and Grenada offer exquisite beachfront properties catering to luxury lifestyles.

When considering investment in these markets, pay attention to factors such as property demand, rental yields, potential for appreciation, and the stability of the local real estate market. Markets with a steady influx of tourists and a solid legal framework for foreign investors tend to offer more robust investment opportunities. Moreover, understanding the local economy’s health and its impact on real estate prices aids in making informed decisions.

Risk Assessment and Long-Term Planning

Assessing risks is critical in safeguarding your investment. Beyond the allure of acquiring citizenship or residency, you must evaluate the political stability of the country, the volatility of its currency, and the resilience of its real estate market to global economic fluctuations. Countries like Turkey, which have seen significant currency depreciation, highlight the importance of considering forex changes in your investment strategy. However, despite currency volatility, real estate in such countries can hold its value against major currencies like the US dollar, demonstrating the importance of thorough market analysis.

Additionally, long-term planning involves understanding the terms of the citizenship by investment program, including any obligations to hold onto your investment for a specified period and eventually selling your property. In countries with citizenship by investment real estate programs, such as Grenada and Dominica, properties might be subject to resale restrictions to other citizenship applicants, which could affect liquidity.

When navigating these complex landscapes, investors benefit from conducting due diligence, seeking expert advice, and considering each country’s long-term economic forecasts. Aligning your investment with your lifestyle preferences, financial goals, and risk tolerance ensures a second passport and a valuable asset that contributes to your wealth over time.

Legal and Fiscal Implications

When venturing into citizenship by real estate investment, understanding your investment’s legal and fiscal implications is crucial. This knowledge ensures compliance and maximizes investment benefits in countries like Dominica, Antigua, Grenada, Cyprus, Greece, Malta, and Spain. Below, you’ll find key considerations to navigate the legal process and understand tax obligations efficiently.

Navigating the Legal Process

Embarking on citizenship by investment in real estate requires thorough navigation of the country’s legal framework. Each country has unique rules governing foreign investment, property ownership, and citizenship eligibility. For instance, programs like the Dominica citizenship by investment real estate or Antigua citizenship by investment real estate entail specific legal requirements regarding the minimum investment amount, property types eligible for investment, and the due diligence process.

First, ensure the property you invest in qualifies for the citizenship program. Countries like Grenada and Antigua have lists of approved real estate projects, including resorts or boutique hotels, that are eligible for their citizenship by investment programs. Understanding these specifications is vital to ensure your investment aligns with the eligibility criteria.

Additionally, it’s paramount to consider any restrictions on property resale, particularly if your investment strategy involves eventually selling the property. Some countries mandate a minimum holding period before resale is allowed, affecting your long-term investment strategy.

Engaging with a reputable legal advisor specializing in citizenship by investment programs can provide tailored advice, helping you efficiently navigate through the legalities, including contract negotiations, compliance with local laws, and ensuring your property purchase smoothly facilitates your citizenship application.

Tax Considerations and Implications

Investing in real estate for citizenship purposes also entails understanding the tax implications in your chosen country. Each country’s tax system affects your investment returns differently, impacting income gained from rental yields and the capital gains tax incurred upon selling the property.

For instance, while pursuing citizenship by investment real estate, consider ongoing property taxes, capital gains tax, and any potential inheritance tax implications. Some countries offer tax incentives to attract foreign investors, which could significantly reduce your tax liability and enhance the attractiveness of the investment.

Furthermore, it’s essential to understand your tax obligations not only in the country of investment but also how this investment affects your tax situation in your home country or primary country of residence. This involves considering double taxation agreements between your home country and the country of investment to ensure you’re not taxed twice on the same income.

Professional advice from a tax advisor experienced in cross-border taxation is invaluable in this regard. They can provide insights into optimizing your tax obligations, taking advantage of any available tax treaties, and effectively planning for any tax liabilities arising from your real estate investment. This proactive approach ensures you’re fully aware of your fiscal responsibilities, helping to maximize the benefits of your citizenship by real estate investment program.

Making an Informed Decision

Navigating the world of citizenship by real estate investment requires careful comparison and consideration of the available programs. This comparison not only hinges on understanding the total investment required but also on comprehending the rights, responsibilities, and benefits associated with residency and citizenship in various countries. It’s paramount to grasp the distinction between residency and citizenship programs, as well as to seek professional advice to ensure that the investment aligns with your long-term personal and financial goals.

Comparing Residency Versus Citizenship Programs

When exploring options for acquiring a new status abroad through real estate investment, you’ll encounter a diverse range of programs offering either residency or citizenship. Each type of program comes with its unique set of advantages that cater to different objectives.

Residency programs usually act as stepping stones towards long-term settlement and potentially citizenship. These programs often require a lower investment threshold and can offer perks like access to healthcare, education, and the ability to work within the country. Countries like Greece and Spain offer residency through real estate investment, granting investors the right to live and sometimes work in the country without providing full citizenship benefits.

Citizenship programs, on the other hand, confer a legal status granting full rights, including the right to vote, work, and enjoy freedom of movement within the country and sometimes within its regional bloc. For instance, citizenship by investment programs in Dominica, Antigua, and Grenada not only offer a quick route to a second passport but also include additional perks such as visa-free travel to numerous countries. The commitment is higher in terms of investment, but the returns in terms of mobility and rights are significantly greater.

Seeking Professional Guidance

Embarking on a journey to acquire residency or citizenship through real estate investment is a significant decision that involves various legal intricacies and financial commitments. Engaging with professionals who specialize in immigration and investment programs is crucial for a successful outcome. Immigration lawyers, tax advisors, and real estate experts can provide guidance tailored to your specific circumstances, helping you navigate through the complex processes involved.

Professionals can provide insights into the nuances of each program, including minimum investment amounts, eligibility of properties, tax implications, and the process of application. They can also help in identifying any potential risks and in maximizing the benefits of your investment. Countries with citizenship by real estate investment programs, including Dominica, Antigua, Grenada, and Turkey, have specific legal frameworks and criteria that must be meticulously followed, making specialized guidance indispensable.

By comparing residency versus citizenship programs and seeking professional guidance, you embolden your decision-making process, enhancing your chances of selecting an investment path that not only meets your current aspirations but also secures your future mobility, safety, and economic prosperity.

Conclusion

Embarking on the journey of acquiring citizenship through real estate investment opens up a world of opportunities. From the sunny shores of the Caribbean to the historic landscapes of Europe and beyond, each country offers its unique benefits and challenges. It’s essential to weigh these carefully against your personal and financial objectives. Remember, this path isn’t just about purchasing property; it’s about making a strategic investment in your future and that of your family. With the right guidance and a clear understanding of the legal, fiscal, and procedural nuances, you can navigate this complex landscape successfully. Whether you’re seeking a new home, a safe haven, or access to global mobility, citizenship by real estate investment can be a rewarding endeavor when done wisely.

Frequently Asked Questions

What countries offer citizenship through real estate investment?

Countries like Dominica, Antigua, Grenada, Cyprus, Greece, Malta, and Spain offer pathways to citizenship through real estate investment. Each country has its own set of benefits, legal requirements, and investment thresholds.

What are the benefits of acquiring citizenship through real estate investment?

Acquiring citizenship through real estate investment offers benefits such as freedom of movement, the right to work and live in the new country, access to healthcare and education systems, and sometimes tax advantages depending on the country’s legal framework.

How much do you need to invest in real estate to get citizenship in countries like Dominica and Antigua?

Investment requirements vary by country. For instance, Dominica and Antigua typically require a real estate investment ranging from $200,000 to $400,000, along with processing and due diligence fees, to qualify for citizenship.

Are there legal and fiscal implications when obtaining citizenship through real estate investment?

Yes, there are significant legal and fiscal implications, including understanding the tax obligations in both the home country and the new country, adhering to the legal frameworks for property ownership, and being aware of any resale restrictions on the property.

What is the difference between residency and citizenship programs in real estate investment?

Residency programs offer the right to live in a country and may include benefits like access to healthcare and education. Citizenship programs provide full national rights, including voting and passport rights, often without the need to reside in the country.

Why is it important to seek professional guidance when investing in real estate for citizenship?

Seeking advice from immigration lawyers, tax advisors, and real estate experts is crucial to understand the nuances of each program, minimize risks, and ensure that the investment aligns with personal and financial goals. Professionals can help navigate the complexities of the legal and fiscal implications involved.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, and take advantage of global residency and citizenship by real estate investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, Citizenship by Investment, Second Residence, Real Estate Investing, citizenship by real estate investment, Second Citizenship, Malta Passport, Antigua Passport, Caribbean Citizenship, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship