The impending changes to Canada’s capital gains tax policy present a significant challenge, particularly for the nation’s wealthy investors and successful entrepreneurs. From June 2024, individuals accruing over $250,000 in annual capital gains will encounter a steep rise in the inclusion rate, from 50% to 67%. This drastic policy shift aims to redistribute wealth by taxing successful investors more heavily, a move that could potentially discourage the very investments that fuel economic growth and innovation. Despite the government’s intentions to level the playing field and increase fairness, the increased tax burden could result in decreased investment activities and a reluctance among entrepreneurs to expand their business ventures.

Meanwhile, the government’s proposal to slightly raise the lifetime capital gains exemption and introduce new incentives for Canadian entrepreneurs seems insufficient to counterbalance the discouraging impact of higher tax rates. These measures appear to be small consolation in light of the significant challenges that lie ahead for those who have traditionally driven Canada’s economic success. Wealthy Canadians are now tasked with navigating a more hostile financial landscape, where careful planning and strategic foresight are more crucial than ever to protect their investments from being excessively taxed under the new policy.

Background of the Canada Capital Gains Tax Increase in 2024

The forthcoming changes to the Canada capital gains tax structure represent a significant shift in tax policy to promote tax fairness and equitable wealth distribution among Canadians. As you navigate these changes, it’s crucial to understand the scope, intention, and historical backdrop of the capital gains tax increase set for 2024.

The Scope and Aim of the Increase

The Canada capital gains tax increase in 2024 targets adjusting the inclusion rate of capital gains for taxation. Specifically, the inclusion rate for capital gains exceeding $250,000 annually will rise to two-thirds, a considerable shift from the current structure. This adjustment essentially means that a larger portion of capital gains will be taxable, directly affecting individuals and entities with substantial investment income.

The primary aim of this tax increase is twofold. Firstly, it strives to enhance tax fairness by ensuring that those with higher investment incomes contribute more proportionally to the nation’s revenue. Secondly, it aims to redistribute wealth more equitably among Canadians, addressing concerns over wealth concentration and providing a balanced approach to taxation. By focusing on capital gains exceeding $250,000, the policy specifically targets the upper echelons of income earners, sparing the average investor from the brunt of the increase.

Historical Context

Understanding the historical context of Canada’s capital gains tax is essential to appreciate the significance of the upcoming changes. Initially introduced in 1972, Canada’s capital gains tax was conceived to tax income generated from the sale of investment assets. Over the years, the inclusion rate—the percentage of capital gains subject to tax—has fluctuated in response to economic conditions, fiscal policy objectives, and changing government priorities.

The upcoming capital gains tax increase in 2024 marks another pivotal moment in the evolution of Canada’s tax policy. It reflects a shift towards addressing contemporary challenges such as income inequality and the need for a more progressive tax system. The policy draws from historical precedents while increasing the inclusion rate for high-value capital gains while adapting to the current socio-economic landscape. This measure underscores a move towards leveraging tax policy as a tool for achieving broader social and economic objectives, including wealth redistribution and the promotion of financial equity.

As you prepare for these changes, understanding the scope and historical foundations of the increase in capital gains in Canada will equip you with the knowledge to navigate the evolving tax landscape effectively.

Who Will Be Negatively Affected by the Tax Increase

As you navigate the complexities of the announced capital gains tax increase in Canada, it’s important to understand who will be impacted. The change, set to take effect in 2024, has created a buzz across various segments of the Canadian populace. Below, we delve into how different groups will feel the effects of this significant tax adjustment.

Impact on High-Income Individuals and Families

The increase in the capital gains tax, specifically targeting those with annual capital gains exceeding $250,000, squarely affects high-income individuals and families. If you fall into this earnings bracket, you’ll see an inclusion rate rise to two-thirds of your capital gains. This means a larger portion of your gains from investments like real estate, shares, or bonds will be taxable. This measure ensures wealthier Canadians contribute more significantly to public coffers, aiming at a “fairer” tax system.

HNWIs and UHNWIs

High Net Worth Individuals (HNWIs) and Ultra-High Net Worth Individuals (UHNWIs) are particularly in the spotlight with the upcoming capital gains tax increase. Since investments often constitute a substantial part of their wealth, the raised inclusion rate directly impacts their financial strategies. As a result, HNWIs and UHNWIs might need to reassess their investment portfolios and tax planning to accommodate the higher tax liabilities expected from 2024 onwards.

Consequences for Business Owners and Entrepreneurs

Business owners and entrepreneurs need to pay close attention to the capital gains tax increase, especially if they’re considering selling their business or have significant investments in other companies. The adjustment in tax rates could influence the timing of such sales and the strategy around reinvestment or capital allocation. Understanding the nuances of how these changes affect business valuation and succession planning is crucial for anyone in this category.

Overall Implications for the Canadian Economy

As we examine the broader economic implications of the impending capital gains tax increase in Canada, it’s clear that this policy is not just about redistributing wealth or addressing income inequality—it could also lead to significant changes in the residency and investment strategies of Canada’s high earners. By increasing the tax burden on substantial capital gains, the government risks not only altering investment behaviors but potentially driving wealthy individuals to reconsider their tax residency.

Motivated by the new tax structure, where individuals with large investment incomes will see a marked increase in taxes owed, some of Canada’s most affluent may find it financially advantageous to relocate to jurisdictions with more favorable tax laws. This shift could see a migration of capital and talent away from Canada, which would have profound implications for the economic landscape. The potential exodus of high-net-worth individuals and their investments could undermine the very goals of these tax changes by reducing the overall tax base and impacting sectors vital to Canada’s economic growth.

As you adjust your financial planning and investment strategies, keeping abreast of these developments and seeking professional advice could be invaluable in navigating the evolving landscape of Canada’s capital gains tax.

Key Features of the Capital Gains Tax Increase

Changes to the Inclusion Rate

The capital gains tax increase for 2024 introduces a critical adjustment in the inclusion rate from one-half to two-thirds for annual gains exceeding $250,000. This alteration targets the equitable distribution of tax responsibilities, primarily affecting individuals with substantial investment incomes. Given the capital gains increase in Canada, you need to understand how this change might impact your financial strategy. The move recognises the need for a more progressive tax system, ensuring those with higher capital gains contribute a larger share to national revenue.

Adjustments to the Alternative Minimum Tax (AMT)

Adjustments to the Alternative Minimum Tax (AMT) will also be made to harmonise with the new capital gains tax structure. These changes ensure that high-income earners cannot excessively benefit from preferences and deductions, including those related to increased capital gains. Specifically, the AMT calculation will be revised to reflect the capital gains tax increase in 2024, maintaining fairness across the tax system. It’s crucial to evaluate how these AMT adjustments might affect your overall tax obligations.

Exemptions and Continued Reliefs

Despite the significant changes, certain exemptions and reliefs will continue, safeguarding the interests of diverse taxpayer groups. Notably, net capital losses of previous years remain deductible against current taxable capital gains, ensuring fair treatment for losses incurred before the rate adjustment. This provision allows for a smoother transition for investors and maintains stability in investment planning.

New Relief Measures for Entrepreneurs

Understanding entrepreneurs’ critical role in the economy, the 2024 capital gains tax increase introduces new relief measures. Entrepreneurs may particularly benefit from the capital gains exemption on up to $2 million in lifetime gains, phased in over ten years. This incentive aims to mitigate the impact of the capital gains tax increase on business owners and incentivize long-term investment in the Canadian economy. It’s an opportune moment for entrepreneurs to review their exit strategies and investment plans in light of these measures.

Navigating the capital gains tax increase in Canada requires careful planning and consideration. Whether you’re an individual investor, a high earner, or an entrepreneur, it’s advisable to stay informed and possibly seek professional advice to optimize your financial decisions amidst these changes.

What This Means for Investors and Business Owners

The recent updates to Canada’s capital gains tax, set to take effect in 2024, represent a significant shift in the taxation landscape, particularly for investors and business owners. Understanding the implications of these changes is crucial for effective financial planning and investment strategy. Let’s explore what this means across different segments of investors and business owners.

Real Estate Investors and Developers

For you as a real estate investor or developer, the capital gains tax increase in 2024 is critical. Post-June 25, the inclusion rate for capital gains tax—the fraction of your gains subject to tax—will jump from one-half to two-thirds. This increase affects not just the sale of properties but also impacts your long-term investment strategies and project feasibility. While the primary residence exemption remains unchanged, large-scale developers and individual investors must recalibrate their return expectations and investment timelines. Considering the increase in capital gains, Canada’s real estate sector might see a shift towards more cautious investment approaches, with a higher emphasis on long-term value creation.

Business Owners and Entrepreneurs

If you’re a business owner or entrepreneur, the revised capital gains tax regime presents both challenges and opportunities. While the capital gains tax increase in 2024 introduces a more substantial tax burden on the sale of business assets or shares above certain thresholds, there’s a silver lining. The increase in the lifetime capital-gains exemption for selling your business—from $1 million to $1.25 million—offers some relief. However, the new Canadian Entrepreneurs Incentive, providing a lower lifetime capital-gains inclusion rate under specific conditions, requires careful navigation to ensure eligibility. With these changes, strategic tax planning becomes even more crucial, especially for those considering business sales or succession shortly.

Full-Time Investors (Stocks, Bonds, Crypto, etc.)

For full-time investors in stocks, bonds, cryptocurrencies, and other securities, the capital gains tax increase in 2024 will inevitably affect investment earnings. With the increase applying to individual capital gains exceeding $250,000, high-volume traders and long-term investors alike need to reassess their portfolio strategies. While the tax increase may encourage a more cautious approach to realizing large gains, it also underscores the importance of tax-efficient investing techniques, such as using Tax-Free Savings Accounts (TFSAs) or exploring sectors with potential for substantial long-term growth, less affected by yearly volatility. As the landscape for capital gains tax becomes more demanding, adopting strategies to mitigate tax exposure while preserving growth potential will be paramount.

The capital gains tax increase in 2024 necessitates a closer examination of your investment and business strategies. Whether you’re dealing in real estate, running a business, or investing full-time, adapting to these tax changes is essential for minimizing impact and optimizing outcomes. As always, consulting with tax professionals to navigate these changes effectively is highly advisable.

Criticism and Support

The debate over the increase in capital gains tax, set to take effect in 2024, illuminates a range of perspectives on economic policy, political decision-making, and the societal impact of taxation changes in Canada. While this move aims for heightened tax fairness, reactions vary widely across economic, political, and public domains.

Economic Concerns

Critics argue that the capital gains tax increase could stifle investment and innovation within Canada. By raising the inclusion rate to two-thirds for annual capital gains exceeding $250,000, investors find themselves at a crossroads. Though intended to promote equity in tax burdens, this adjustment might hinder domestic and international investors from engaging heavily in the Canadian market. Economic experts express worries about potential slowdowns in venture capital funding and real estate development, sectors historically sensitive to changes in capital gains taxation. Conversely, supporters highlight the potential for redirecting investment towards longer-term and potentially more sustainable projects, believing that the increase could discourage speculative investments and foster a more stable economic environment.

Political Reactions

Political responses to the capital gains tax increase in 2024 have been predictably polarised. Opposition parties view the tax adjustment as a barrier to economic growth and prosperity, fearing it might send a negative message to entrepreneurs and investors about Canada’s business climate. On the other hand, proponents within the government and some progressive circles applaud the initiative for its aim to ensure a higher degree of tax fairness. They argue it’s a necessary step towards reducing income inequality, by ensuring that those with substantial investment incomes contribute more significantly to the nation’s tax revenues. This division reflects broader ideological differences over how best to manage the country’s economy and tax system.

Public Opinion

The Canadian public’s opinion on the capital gains tax increase is mixed, mirroring the issue’s complexity. Some taxpayers welcome the change, viewing it as a move towards a more equitable tax system that requires the wealthy to pay their fair share. This sentiment is particularly strong among groups who feel that the current economic system disproportionately favours the rich. However, there is a substantial segment of the population concerned about the potential implications for personal investments and the broader economy. Middle-class individuals, who might be aspiring to reach that $250,000 threshold through diligent saving and investing, worry about being penalised for their efforts to achieve financial security. Social media platforms and forums are abuzz with discussions, showcasing the diverse viewpoints and the depth of concern among Canadians about how these changes will affect their financial future.

In navigating the criticism and support for the capital gains tax increase set for 2024, it’s clear that balancing economic growth, political feasibility, and public sentiment remains a challenging endeavour. The coming months are likely to see continued debate as stakeholders from all sides of the spectrum seek to influence the final implementation of this policy.

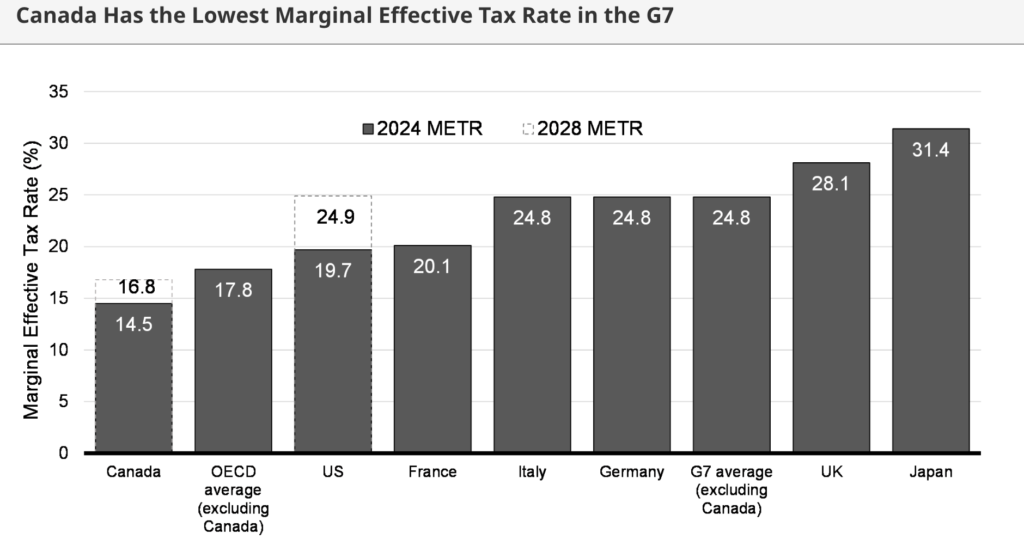

Comparison with International Standards

How Canada’s Approach Compares to Other Countries

In exploring the adjustments made to the capital gains tax structure in Canada, particularly with the planned increase in 2024, it’s essential to consider how this approach stacks up against international standards. Canada’s decision to raise the inclusion rate for individuals with annual capital gains exceeding $250,000 to two-thirds reflects a targeted strategy to ensure tax equity and efficiently fund public services. This modification aligns with a global trend where countries are re-evaluating their capital gains tax policies to adapt to economic demands and social priorities.

Most OECD countries have distinct approaches to capital gains taxation, with rates and rules varying significantly across borders. For instance, the United States has a tiered system where long-term capital gains tax rates depend on the taxpayer’s income level, ranging between 0% and 20%, not including state taxes which can further increase the burden. In contrast, countries like Belgium do not tax capital gains on shares for individual investors under certain conditions, presenting a much more favourable environment for capital gains.

The United Kingdom offers another comparison point, where capital gains tax rates for individuals are set at 10% for basic-rate taxpayers and 20% for higher or additional-rate taxpayers on assets, with exceptions like residential property, where rates are higher. This system, while simpler than Canada’s evolving framework, presents a mix of incentives and levies that dynamically impact investment decisions.

In comparing Canada’s capital gains tax increase for 2024 to those of other countries, the focus on high earners and substantial gains is a common thread among nations striving for fiscal balance and social fairness. Countries like Australia also adopt a more progressive tax system, where the rate increases with the income, though they offer a 50% discount on capital gains for assets held longer than a year, a feature that Canada’s system lacks.

Moreover, the global move towards adjusting capital gains taxes often reflects an intention to curb speculative investment and encourage long-term growth. The necessity to invest in sustainable and social projects instead of short-term profit avenues has led countries, including Canada, to rethink their strategies.

Navigating the Changes

With the impending capital gains tax increase in Canada by 2024, understanding and navigating through these alterations become paramount. The increase reflects a significant shift in tax policy, necessitating a closer look at how Canadians can adapt. Below, find key strategies and advice to effectively guide you through the changes.

Planning Strategies for Canadians

Ahead of the capital gains tax increase in 2024, it’s crucial to reassess your investment portfolio and real estate assets. Diversifying investments and considering the timing of asset sales can mitigate potential tax impacts. For real estate investors, exploring the Principal Residence Exemption and the possibility of leveraging it before the hike becomes vital. Business owners should evaluate their business structure and the timing of asset liquidation to take advantage of lower rates before they rise. By starting early, you’ll position yourself to navigate the capital gains tax increase with confidence.

Professional Advice and Resources

Navigating the complexities of the capital gains tax increase necessitates professional guidance. Tax professionals and financial advisors can offer personalized strategies that align with your financial goals and tax situation. Moreover, utilizing resources such as the Canada Revenue Agency (CRA) website provides up-to-date information on tax laws. Professional seminars and workshops focusing on tax planning in light of the capital gains tax increase can also equip you with the knowledge needed to make informed decisions.

Advanced Tax Strategy Implementation

Given the capital gains tax increase in 2024, leveraging advanced tax strategies becomes crucial. Exploring options such as tax-loss harvesting can offset capital gains and reduce your taxable income. Structuring your investments to favour growth over income can also help minimise your exposure to higher taxes. For those with significant investment portfolios, considering the creation of a private corporation might offer beneficial tax planning opportunities, subject to professional advice reflecting your specific circumstances.

Becoming a Non-Resident for Tax Purposes

For some, the increased capital gains tax might prompt considerations of becoming a non-resident for tax purposes. It’s a significant decision that requires thorough planning and professional advice, considering the tax implications in Canada and the new jurisdiction. Understanding the residency requirements, the potential impact on your Canadian and global income, and the legal process is essential. This route offers potential relief from the capital gains tax increase but comes with substantial changes to your financial landscape and obligations.

Navigating through Canada’s capital gains tax increase demands proactive planning, professional advice, and potentially complex strategic implementation. By starting early and staying informed, you can position yourself to manage the changes effectively, ensuring your financial decisions align with both current and upcoming tax landscapes.

Conclusion

The significant changes coming to Canada’s capital gains tax signal a crucial period for reassessment and strategic planning, particularly for those considering the significant benefits of potentially changing their tax residency to mitigate the financial impacts of these changes. Exploring various strategies such as tax-loss harvesting, diversifying your investment portfolio, or even seriously reevaluating your residency status to take advantage of more favourable tax conditions elsewhere could decisively shape your financial future. In these times, obtaining professional advice becomes indispensable—not only to ensure compliance with the new tax laws but also to effectively navigate these potentially challenging financial waters. By considering a move to a tax-advantageous country, you can align with the best financial strategies to continue thriving despite Canada’s evolving economic environment.

Frequently Asked Questions (FAQ)

1. How much capital gains tax do I pay on $ 100,000 in Canada?

Currently, you would add $50,000, which is 50% of your $100,000 capital gains, to your total taxable income for that year, and the tax you pay would depend on your overall income tax rate.

2. Is 50% the standard capital gains tax rate in Canada?

Yes, in Canada, 50% of the value of any capital gains is considered taxable income. If you realize a capital gain, you must add 50% to your taxable income for the year.

3. How do I calculate capital gains tax on the sale of property in Canada?

To calculate capital gains tax, subtract the purchase price from the selling price to determine your capital gain, then add 50% of this capital gains amount to your income. This 50% is what’s taxable at your income tax rate.

4. What is the current capital gains tax rate in Canada?

In Canada, the current system taxes 50% of your capital gains as income. This means only half of the profit from selling an asset is added to your taxable income. As of June 25th, 2024, this is now moving to 66% of the capital gain on income earned, a significant increase.

5. What are the upcoming changes in capital gains tax for 2024?

The capital gains inclusion rate will increase to two-thirds (66.66%) for corporations, trusts, and individuals with annual capital gains exceeding $250,000. This change applies to capital gains realized on or after June 25, 2024.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, Citizenship by Investment, Second Residence, Real Estate Investing, Canada Capital Gains Tax, Exit Tax Canada, Canada Exit Tax, Justin Trudeau, 2024 Canada Tax, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship