Barbados’s economic and tax landscape, an island nation in the Eastern Caribbean, has evolved significantly over the years. From its early economy centred around sugar cane cultivation, Barbados has transitioned into a service-oriented economy focusing on tourism, international business, and financial services. This transformation has been underpinned by deliberate policy choices to attract foreign direct investment (FDI) and foster economic development.

Historically, Barbados capitalized on its strategic location and political stability to develop a thriving tourism industry. This, alongside agriculture, formed the backbone of its economy for much of the 20th century. However, recognizing the limitations of these sectors in driving sustainable economic growth, Barbados embarked on a diversification strategy in the late 1990’s. This strategy focused on developing the international business sector and financial services, leveraging the country’s reputation for transparency, regulatory compliance, and an attractive tax regime.

Overview of Barbados Tax Residency

Barbados tax residency might seem daunting at first glance, but with the right information, it’ll be simpler. Determining your tax residency is crucial as it significantly affects how your income is taxed. If you’re living in Barbados or considering moving there, understanding the nuances of tax residency will ensure you’re not caught off guard when tax season rolls around.

Barbados considers an individual a tax resident if they are present in the country for more than 182 days in a given income year. However, residency alone doesn’t determine your tax obligations. Your domicile status, which relates to your permanent home or significant connection to Barbados, also plays a critical role. Individuals who are both residents and domiciled in Barbados are taxed on their worldwide income, whereas those not domiciled in the country are only taxed on their income derived or received in Barbados.

For companies, the determination takes a different route. A company is deemed a tax resident in Barbados if it’s managed and controlled from within the country. This includes board decisions, key management activities, and where the central administration occurs. The implications are significant because tax residency dictates how profits are treated, especially from foreign subsidiaries.

- Tax-free repatriation of dividends represents a key feature. Dividends paid by a foreign non-resident company to a Barbados-resident company are exempt from tax, provided the Barbados company owns 10% or more of the share capital, and the investment isn’t considered a portfolio investment.

Understanding these key points about tax residency in Barbados ensures that both individuals and corporations can navigate the tax landscape more effectively. With this knowledge, you can plan your financial activities in the country, ensure compliance, and make the most of the available tax benefits.

Benefits of Barbados Tax Residency

Barbados tax residency offers numerous attractive benefits that can significantly influence your financial planning and investment strategy. From its network of double taxation treaties to the absence of capital gains tax, these advantages can significantly enhance the profitability and efficiency of individuals and businesses alike. Let’s delve into the specifics.

Double Taxation Treaties

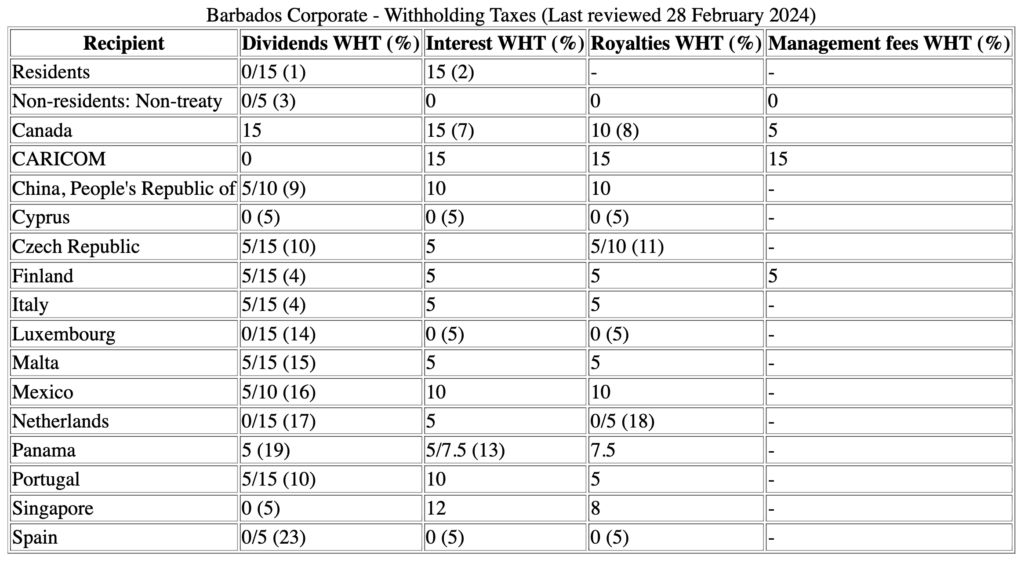

Barbados has established an extensive network of double taxation treaties with countries around the globe. These treaties are designed to prevent the same income from being taxed by two countries, promoting international trade and investment. If you’re a tax resident in Barbados and another country, you’ll likely be protected from double taxation on the same income. This can lead to significant tax savings and simplify managing your international financial affairs.

Low Corporate Tax Rates

Barbados offers some of the most competitive corporate tax rates globally. The country has a multi-tier tax system that caters to different types of businesses, with rates as low as 5.5% and up to 9% if the corporation generates more than BB $2M (US $1M) in profits. This favourable tax regime reduces the financial burden on companies and makes Barbados an attractive destination for establishing and operating international and local businesses.

No Capital Gains Tax

One of the most significant benefits of Barbados tax residency is the absence of capital gains tax. Regardless of your resident status, Barbados does not levy taxes on capital gains from the sale of assets or investments. This policy provides a clear advantage for investors, enabling you to maximize the returns on your investments without worrying about a significant tax bill from any gains realized.

Certain Exceptions on Foreign-Sourced Income

While Barbados taxes residents on worldwide income, there are certain exceptions regarding foreign-sourced income. If you’re a resident but not domiciled in Barbados, you’re taxed only on the income that is either derived from or remitted to or enjoyed within Barbados. This unique approach to foreign-sourced income can provide considerable tax benefits, especially for those who generate income in multiple countries but choose only to bring a portion of it into Barbados. It allows for strategic financial planning and the potential to reduce your overall tax liability significantly.

These features highlight Barbados’ appeal as a jurisdiction for individuals and corporations looking to optimize their tax positioning. By leveraging the benefits of Barbados tax residency, you can achieve greater efficiency and sustainability in your financial and business endeavours.

Other Advantages of Barbados Tax Residency

Besides the attractive tax benefits, Barbados offers numerous advantages that can significantly enhance your lifestyle and financial planning strategy. From banking facilities tailored for international clientele to a gateway towards citizenship, here’s what you need to know.

Banks in Barbados

Barbados hosts a variety of banks, accommodating both local and international clients. Opening an account here is a straightforward process, with most banks requiring just a reference from your current bank. The presence of global banks ensures that, as a tax resident, you’ll have access to international banking facilities alongside efficient online services, making managing finances from anywhere in the world hassle-free.

Flight Accessibility

One key benefit of Barbados tax residency is the island’s excellent flight connectivity with major cities around the globe. Regular flights to the UK, Europe, the US, and Canada mean you and your family can easily travel in and out of Barbados. This accessibility makes it convenient for personal travel and supports business activities, offering the perfect blend of leisure and professional opportunities.

Weather and Lifestyle

Barbados is renowned for its idyllic weather conditions, boasting a warm climate year-round with an average temperature of 28°C. This, coupled with the island’s vibrant culture, exquisite beaches, and culinary delights, offers a lifestyle that’s hard to match. As a Barbados tax resident, you invest in a tax efficiency strategy and a lifestyle promoting health, well-being, and happiness.

Safety and Security

When considering relocation for tax purposes, safety and security are paramount. Barbados ranks highly as one of the safest Caribbean islands, providing a stable environment for individuals and families. The island’s low crime rate and friendly community ensure that residents always feel safe, whether conducting business, enjoying local amenities, or exploring Barbados’s stunning landscapes.

Pathway to Barbados Citizenship

For those considering a long-term move, Barbados offers tax residents a clear pathway to citizenship. By maintaining your residency status and complying with the stipulated requirements, you could eventually qualify for citizenship. This solidifies your tax planning strategy and provides a passport that offers visa-free access to numerous countries, including the UK and Europe, enhancing your global mobility. For business persons or investors from developing countries, the Barbados passport could have significant advantages for you and your family.

Barbados’s tax residency program extends far beyond mere tax benefits. It’s about embracing a lifestyle that combines financial efficiency with personal satisfaction and security.

Types of Taxes in Barbados

Navigating Barbados’s tax landscape requires a clear understanding of the various types of taxes that may apply to individuals and businesses. This guide dives deep into the primary taxes in Barbados, namely Income Tax, Value-Added Tax (VAT), and Import Duties and Fees, providing you with concise information to better manage your tax obligations.

Income Tax

In Barbados, income tax is a key component of the national tax system, affecting salaries, bonuses, and all other forms of income. For residents, personal income tax rates are structured progressively. The initial BBD 50,000 of taxable income is taxed at a basic rate, while income exceeding this threshold faces a higher rate of 28.5%. You must be aware that special concessions can substantially reduce the tax burden for qualified foreign employees, who may exempt up to 60% of their remuneration from tax.

On the other hand, corporate entities should prepare for income and profits taxation, emphasizing that dividends, interests, rents, and royalties are all subject to taxation. However, interestingly, 50% of the amount received as royalties is exempt from tax, presenting a notable deduction opportunity.

Value Added Tax (VAT)

VAT is an essential aspect of the Barbados taxation system, affecting most goods and services sold within the country. The standard VAT rate is 17.5%. Certain items and services, such as hotel accommodations and tourism supplies, enjoy a reduced VAT rate of 7.5%. Moreover, there are zero-rated activities, predominantly in agriculture, exports, and specific food services, which allow businesses to claim refunds on VAT paid on their expenditures without charging VAT on their revenues.

Import Duties and Fees

If you’re involved in importing goods into Barbados, be prepared for the application of import duties and fees. These duties are calculated based on the value of the imported goods and vary depending on the category of items. The aim is to protect local industries and generate revenue, making it imperative that importers understand the applicable rates and exemptions. Beyond standard duties, additional fees, such as environmental levies and excise taxes, may apply to specific items. Staying informed about these charges is crucial for accurately forecasting the total cost of imports and avoiding any unexpected expenses.

In understanding these three key types of taxes in Barbados, you’re better positioned to navigate the tax landscape. This is true whether you’re living in Barbados, considering moving there, or involved in business operations on the island.

Challenges With Barbados Tax Residency

Navigating Barbados’s tax system’s complexities poses unique challenges for individuals and businesses aiming to establish tax residency on the island. Recognizing these hurdles is essential for successful fiscal planning and compliance.

Compliance Issues

Establishing tax residency in Barbados involves more than merely spending the required days on the island. To benefit from the tax system, you must understand and adhere to a myriad of regulations and fulfill specific criteria. The first notable challenge is navigating the intricate tax laws. Barbados’s tax legislation is extensive and often updated, making it crucial for potential tax residents to stay informed or seek professional advice to ensure compliance.

Another significant aspect is documentation and reporting. The Barbados Revenue Authority mandates strict compliance with documentation and timely tax filings. This process can be daunting, especially for those unfamiliar with the tax environment. Maintaining accurate financial records and understanding the reporting requirements are vital to avoid penalties.

Tax Evasion Concerns

Tax evasion is a global issue, and Barbados is no exception. The country has been under scrutiny for its tax policies, often accused of being a haven for tax evasion. This perception complicates the tax residency process, as authorities have implemented stringent measures to combat illicit financial flows. Enhanced scrutiny on applications for tax residency means that individuals and businesses may face prolonged processing times and additional scrutiny.

Moreover, the global push towards transparency and information sharing has seen Barbados entering agreements to exchange financial information with other countries. This initiative aims to curb tax evasion but also means that tax residents in Barbados can expect their financial information to be shared with tax authorities in their home countries, adding a layer of complexity to tax planning.

Understanding these challenges and preparing accordingly can smooth the path to establishing a beneficial tax residency in Barbados. Whether it’s staying updated on tax laws, ensuring meticulous record-keeping, or navigating international tax compliance, the key lies in being informed and proactive.

Is Barbados Tax Residency The Right Move?

Barbados offers tax incentives to individuals and corporations to foster business development and investment. For individuals, personal income tax rates are progressive, and various statutory tax exemptions are available. These incentives are crafted to support sectors like small business development, tourism, and renewable energy.

The corporate tax landscape is equally appealing for corporations, particularly those involved in international business. The application of corporate tax rates varies, incorporating incentives for foreign currency earnings and concessions for approved activities. However, the benefits of such incentives must be weighed against the requirements and implications of maintaining tax residency.

Moreover, Barbados’ network of Double Taxation Agreements (DTAs) can be a critical factor in your decision. These agreements, aimed at avoiding double taxation and preventing fiscal evasion, cover numerous countries and offer potential tax planning benefits that could enhance the attractiveness of Barbados tax residency.

Conclusion

Barbados tax residency is a strategic move that demands careful consideration and careful planning. With its appealing tax incentives and a supportive environment for business and investment, Barbados stands out as a prime location in the region. Yet, it’s crucial to dive deep into the nuances of DTAs and comply with local tax laws to ensure your financial strategy aligns with your goals and sources of income. Engaging with tax professionals can illuminate the path forward, helping you to leverage the benefits while adhering to regulations. Remember, making Barbados your tax haven is not just about enjoying the perks today but securing your financial future.

Frequently Asked Questions (FAQ)

Is Barbados still a tax haven?

Barbados is recognized for offering a favourable tax environment rather than a traditional tax haven. It provides attractive tax benefits for offshore companies, with taxes on profits ranging from 0 percent to 5.5 percent, depending on the profit margins.

What is the bedroom tax in Barbados?

Barbados imposes a specific tax on accommodations: – Hotel Luxury class at BDS $20.00 per bedroom per night. – Vacation Rental Properties at 2.5% of the nightly rate per bedroom, capped at BDS $20.00. – Villas are also taxed at 2.5% of the nightly rate.

How does land tax work in Barbados?

In Barbados, land tax rates vary by property type: improved residential, non-residential, and vacant land. Each category is taxed differently based on its classification and value.

What is the average salary in Barbados?

The average annual salary in Barbados is approximately BB $83,656, equating to an hourly rate of BB $40. The top 75th percentile of earners can make over BB $95,710 annually.

What is 15% tax in Barbados?

Barbados typically levies a 15% withholding tax on income as per the Barbados Income Tax Act. However, based on specific treaty agreements, the rates may vary for dividends (0-15%) and interest (5-15%).

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, Barbados Tax Residency, Canada Barbados Tax Treaty, Banks in Barbados, Tax Haven, CARICOM, Second Residence, Pathway to Citizenship, Real Estate Investing, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship