Navigating the maze of US tax obligations can be a daunting task, especially if you’re a US citizen living abroad. You’re not just dealing with a new culture and language; there’s also the complex world of expat taxes. The US is unique in its approach to taxing citizens on worldwide income, regardless of where they live. This means your global income is subject to US taxes, a fact that surprises many. Understanding obligations for US citizens living abroad taxes is crucial to avoid penalties, interest charges, and even issues with passport renewal.

Whether you’re soaking up the sun in Spain or navigating the bustling streets of Tokyo, the IRS expects you to file your federal tax return. Let’s dive into the basics of US expat tax rules and requirements, ensuring you’re well-informed and compliant.

Strategies for US Citizens to Pay Less Tax

In the maze of US tax obligations, finding legal pathways to minimize your tax burden can feel like a daunting task. As a US citizen living abroad, it’s vital to explore various strategies to lessen your tax impact while staying compliant with IRS regulations. Below, we delve into methods that could potentially lower your tax obligations.

Deductions and Tax Deferral Strategies

First and foremost, familiarizing yourself with deductions and tax deferral options is crucial. The Foreign Earned Income Exclusion (FEIE) allows you to exclude a portion of your foreign earnings from US taxation. For the tax year 2021, the exclusion amount was up to $108,700 per person. Pairing the FEIE with the Foreign Housing Exclusion can further reduce your taxable income by covering certain housing costs above a base amount.

Leveraging retirement accounts offers another avenue for tax deferral. Contributing to qualified retirement plans, like an Individual Retirement Account (IRA) or a 401(k), can lower your taxable income now, though you’ll pay taxes upon withdrawal in retirement. Understanding these strategies and applying them carefully can result in significant tax savings.

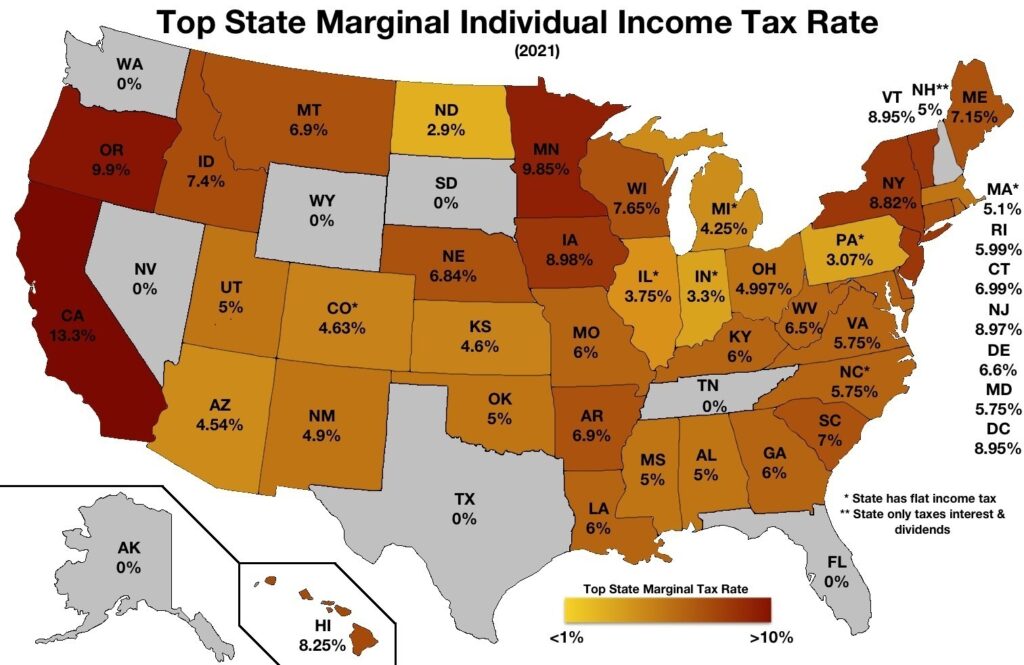

Move to a More Tax Friendly State

Before moving abroad, consider establishing residency in a state with low or no income tax. Not all states tax their residents equally, and your last state of residence can still tax your worldwide income even if you live overseas. States with low income tax or none at all, such as Florida, Texas, and Nevada, could be advantageous options. By strategically choosing your state of residency, you can minimize or eliminate state income taxes, which is a critical step for reducing your overall tax burden as a non-resident.

US Citizens Living Abroad Taxes in a Treaty Country

Residing in a treaty country can offer unique tax benefits due to agreements between the United States and your host country. These tax treaties are designed to prevent double taxation on the same income. By understanding the specific provisions of the treaty between the US and your country of residence, you might find opportunities to claim certain exclusions or tax credits that would not otherwise be available. It’s essential to consult with a tax professional who is knowledgeable about the treaty to make the most of these opportunities.

Take Advantage of Puerto Rico Tax Haven Status

Puerto Rico Tax offers enticing incentives for US citizens considering a move to this US territory. Thanks to Acts 20 and 22 (now consolidated into Act 60), residents who qualify can benefit from a 4% corporate tax rate, and possibly 0% tax on dividends and capital gains. It’s a compelling option for entrepreneurs and investors seeking tax efficiency. However, to take advantage of Puerto Rico’s tax haven status, you must become a bona fide resident, meaning you spend at least 183 days there each year among other requirements. This option requires a significant lifestyle change but could result in substantial tax savings.

Renounce Citizenship and Relocate to a Tax Free Country

While a drastic measure, renouncing US citizenship is the ultimate step in freeing yourself from US tax obligations on your worldwide income. Opting for citizenship in a tax-free or tax-friendly country can eliminate US taxes. Nonetheless, it’s essential to approach this decision with caution and thorough planning. The process involves considerable legal and financial implications, including a potential Exit Tax for high-net-worth individuals. Before taking this step, it’s imperative to consult with legal and tax professionals to fully understand the repercussions and ensure that your new country’s tax policies align with your financial goals.

Engaging with these strategies requires a detailed understanding of tax laws and careful planning. Tailoring these methods to your unique situation can help optimize your financial health while ensuring compliance with US and foreign tax obligations.

Best States with No Income Tax

When living abroad, managing your taxes can be quite the juggle, particularly if you’re still liable for state taxes back in the US. Choosing a home base wisely can save you a significant amount on US income taxes. While Puerto Rico Tax benefits are often talked about for their favorable conditions, States with no income tax offer similar advantages without the complexity of dealing with non-resident tax issues. Here’s a look at some of the best states to consider if you want to minimize your tax burden.

Florida

Florida isn’t just about sunny beaches and theme parks; it’s also one of the most tax-friendly states for US citizens living abroad. With no state income tax, your global income won’t be subject to state taxation, making it an ideal domicile. Additionally, Florida does not require non-resident tax filing, simplifying your tax responsibilities. This makes the “Sunshine State” not only a tourist paradise but also a haven for tax savings.

Texas

Texas, known for its vast landscapes and dynamic cities, offers more than just visual appeal. It’s one of the states with no income tax, ensuring that your foreign earnings remain untouched by state tax authorities. Living abroad and choosing Texas as your tax home can offer a sense of financial freedom, allowing you to enjoy the fruits of your labor without worrying about an additional tax layer on your income.

New Hampshire

While New Hampshire might impose taxes on dividends and interest, it stands out for having no state income tax on earned wages. This distinct approach makes it an attractive option for US citizens residing abroad, especially if your income predominantly comes from wages rather than investments. Keep in mind, though, the specific tax implications on dividends and interest if you have substantial investment income.

Nevada

Beyond the allure of Las Vegas, Nevada offers substantial tax advantages for expatriates. With no state income tax, your worldwide income is exempt from state taxes, aligning with the financial goals of many US citizens living overseas. Nevada’s stance on no income tax extends to both residents and non-residents, solidifying its position as a tax-friendly state for expatriates looking to optimize their tax situation.

Alaska

Alaska might be known for its stunning landscapes and rugged lifestyle, but it’s also noteworthy for its tax policies. As a state with no income tax, it provides a unique financial benefit for those living abroad. Alaska goes a step further by offering an annual Permanent Fund Dividend, derived from oil revenues, to its residents. While you need to meet specific residency criteria to qualify, it’s an added perk that complements the tax savings of having no state income tax.

Choosing a state with no income tax as your domicile before moving abroad can significantly reduce your tax liabilities and simplify your financial planning. While enjoying your life overseas, it’s crucial to stay informed and compliant with your tax obligations, always considering states with low or no income tax to optimize your fiscal health.

Top Countries to Live with Tax Treaty Benefits

Exploring the globe for the perfect place to live as a US citizen doesn’t just involve finding breathtaking landscapes or vibrant cultures. An often overlooked, yet crucial aspect, involves understanding how the tax landscape can affect your financial health, especially when it comes to the benefits available through tax treaties. These agreements ensure that you’re not taxed twice on the same income and often provide attractive tax savings. Here, we delve deep into countries boasting favorable tax treaty benefits with the US.

Barbados

Barbados stands out not only for its stunning beaches and warm climate but also for its favorable tax treaty with the United States. This treaty aims to avoid double taxation and promote mutual economic cooperation between the two countries. For US citizens living in Barbados, this means potential savings on taxes on income earned within Barbados. The agreement covers various types of income, including dividends, interest, and pensions. Furthermore, for individuals involved in international business or digital nomadism, Barbados offers an attractive environment due to its stable economy and quality of life. Remember, while the island paradise might tempt you with its natural beauty, it’s the tax treaty that could significantly impact your decision to call Barbados home.

Italy

Italy, a country celebrated for its rich history, art, and culinary excellence, also offers compelling reasons for US expats seeking tax efficiency. The tax treaty between Italy and the United States includes provisions that help manage the potential for double taxation on income, including pensions, royalties, and capital gains. Italy’s tax code also provides deductions and credits for taxes paid to foreign countries, which can be particularly beneficial for US citizens residing there. Additionally, Italy has introduced a special tax regime for new residents, significantly reducing taxable income for a period, making it an enticing option for those considering a move. Living in Italy not only immerses you in a culture of profound history and delicious cuisine but also offers a thoughtful way to manage your taxes as a US expat.

Malta

When considering relocation for favorable tax treatment, Malta should be high on your list. This Mediterranean island boasts a comprehensive tax treaty with the US, designed to prevent double taxation on the same income while fostering cross-border economic activity. Malta is especially attractive for retirees and digital nomads due to its non-resident tax scheme, which taxes individuals only on income remitted to or arising in Malta. This framework benefits US citizens living in Malta by potentially reducing their overall tax burden. The country’s appealing climate, English-speaking population, and position within the European Union add layers of allure for expatriates from the US.

Ireland

Ireland’s reputation for its lush landscapes and friendly locals is well-deserved, but it’s the tax treaty with the US that draws in financially savvy expats. This treaty minimizes the risk of double taxation for US citizens by allowing them to claim credits or deductions for taxes paid in Ireland. The country’s corporate tax policies have made it a global hub for various industries, offering employment opportunities for expatriates. Ireland’s non-resident tax system further incentivizes US citizens to consider relocation, as individuals are taxed only on income sourced within the country. Settling in Ireland can thus be a wise move, marrying the allure of Celtic culture with tangible tax benefits.

Navigating the tax implications of living abroad is a complex but crucial component of your relocation decision. Tax treaties play a pivotal role in shaping your financial landscape overseas. By choosing a country with a favorable tax treaty with the US, you can enjoy your new home without worrying unnecessarily about the tax bill.

Understanding the Basics of US Taxes for Citizens Living Abroad

When you’re living abroad, navigating the complexities of the US tax system might feel like a daunting task. However, understanding key concepts such as the differences between resident and non-resident taxpayers, how the Foreign Earned Income Exclusion (FEIE) works, and your tax filing obligations can significantly simplify the process. Let’s dive into these important areas to ensure you remain compliant while potentially minimizing your tax liabilities.

What is the Difference Between Resident and Non-Resident Taxpayers?

The IRS differentiates between resident and non-resident taxpayers, impacting how you’re taxed on foreign income. As a US citizen living abroad, you’re generally considered a resident taxpayer with a global income tax obligation. This status requires you to report all income, whether earned in the US or abroad, to the IRS.

Non-resident taxpayers, often individuals who are not US citizens or Green Card holders, are taxed only on their income from US sources. Certain states with low income tax, or no income tax, offer advantages for US citizens abroad when establishing a residency for tax purposes. Knowing your tax residency status is crucial for accurately reporting income and understanding your tax obligations.

How Does the Foreign Earned Income Exclusion Work?

One of the most significant reliefs for US citizens living abroad is the Foreign Earned Income Exclusion (FEIE). This provision allows you to exclude up to a certain amount of your foreign earned income from US taxes. For 2023, the exclusion amount is $112,000. It’s essential to note that the FEIE applies only to income earned through employment or self-employment activities in a foreign country.

To qualify for the FEIE, you must meet either the Physical Presence Test or the Bona Fide Residence Test, essentially proving your lengthy stay or residency in a foreign country. The FEIE cannot be applied to non-earned income, such as dividends or interest, which are subject to different tax rules.

What are the Tax Filing Obligations for US Citizens Living Abroad?

All US citizens, regardless of where they live, are required to file a US tax return if their income exceeds the IRS-defined thresholds. This includes not only wages and salaries but also investment income and passive income streams. Filing a tax return is mandatory even if you owe no US tax, possibly due to the application of the FEIE or tax credits for taxes paid to foreign countries.

In addition to the standard Form 1040, you may need to file additional forms related to foreign assets or bank accounts, such as the FBAR (FinCEN Form 114) and Form 8938, Statement of Specified Foreign Financial Assets. It’s important to carefully document your income, foreign taxes paid, and residency status to optimize your tax situation and avoid penalties.

For US citizens residing in Puerto Rico, specific tax rules apply due to its unique status. Income generated within Puerto Rico may be exempt from US federal taxes, highlighting the importance of understanding regional tax regulations that can affect your overall tax strategy.

Important Considerations for US Citizens Living Abroad

As a US citizen residing outside the United States, navigating your tax obligations can feel like moving through a labyrinth. Understanding the nuances of your tax responsibilities is crucial to avoiding penalties and maximizing your benefits. This section delves into key aspects that significantly impact your tax situation.

Impact of Dual Citizenship on Taxes

Holding dual citizenship can introduce complexity into your tax filings. The United States taxes its citizens on their global income, regardless of where they live or earn their income. If you’re a dual citizen, you’re still bound by US tax laws alongside the tax rules of your country of residence. This does not necessarily mean you’ll pay taxes twice on the same income, thanks to mechanisms such as the Foreign Tax Credit. However, it does entail a meticulous reporting process to ensure compliance with both jurisdictions. Navigating the interplay between US tax obligations and those of your second citizenship requires a deep understanding of bilateral tax treaties and the specific tax rules of both countries.

Foreign Tax Credit: How Does it Affect Your Tax Liability?

For US citizens living abroad, the Foreign Tax Credit (FTC) is a vital tool to avoid double taxation. The FTC allows you to offset taxes paid to a foreign government against your US tax liability on the same income. For instance, if you’ve paid income tax to the government of your residence country, you can claim those taxes as a credit against your US taxes. This could significantly reduce your US tax bill or even eliminate it in some cases. There are limits and conditions to how much credit you can claim, so it’s essential to understand the Fine Print or consult with a tax professional. It’s worth noting that not all taxes paid to a foreign government qualify for the FTC, and there are specific forms and documentation required to claim this credit.

Reporting Foreign Bank Accounts: FATCA Requirements

Living abroad often means having bank accounts in a foreign country. The Foreign Account Tax Compliance Act (FATCA) mandates US citizens to report these accounts if their total value exceeds certain thresholds at any point during the calendar year. The reporting threshold for individuals living abroad is $200,000 at the end of the year or $300,000 at any time during the year. For married couples filing jointly, these thresholds double. Non-compliance with FATCA can result in hefty penalties, stressing the importance of accurate and timely reporting. Furthermore, under the FATCA framework, foreign financial institutions are also required to report the holdings of US citizens to the IRS, increasing transparency and the likelihood of detection for non-reporting.

Navigating the complexities of US taxes as a citizen living abroad doesn’t have to be an overwhelming task. By keeping these considerations in mind and seeking professional advice when necessary, you can ensure compliance and optimize your tax situation.

Navigating Complex Tax Situations for US Citizens Living Abroad

As a US citizen living abroad, you’re navigating a labyrinth of tax obligations that extend beyond borders. Understanding these complexities is paramount to ensuring you remain compliant with IRS regulations while striving for an optimal tax strategy. Let’s break down several key areas you’ll need to pay attention to.

Self-Employment and Freelance Income: How to Report and Deduct Expenses

If you’re generating income through self-employment or freelance work while living abroad, reporting your income and deductions accurately is crucial. The Foreign Earned Income Exclusion (FEIE) allows you to exclude a portion of your foreign earnings from US taxes. For 2023, the exclusion amount is $112,000. To qualify, you must meet either the physical presence test or the bona fide residence test.

Beyond the FEIE, you can also deduct business expenses. These include supplies, advertising, travel, and home office expenses, directly related to your work. Remember, though, that you’re still liable for Self-Employment Tax, which covers Social Security and Medicare. Unlike income tax, there’s no exclusion for these taxes, but bilateral agreements, known as Totalization Agreements, may exempt you from double taxation in this area.

Retirement Accounts: Options and Tax Implications for Expats

Managing retirement accounts from abroad is a common concern for expats. Traditional and Roth IRAs, 401(k)s, and other retirement accounts have specific reporting requirements and tax implications. Contribution to these accounts often depends on your qualification for the FEIE and whether you have eligible earned income.

Distributions from these accounts while living abroad can also have tax implications. States with low income tax or no state income tax, like Florida or Texas, may be more favorable if you have a choice in establishing residency before moving abroad. Additionally, Puerto Rico tax exemptions for certain residents could offer unique advantages for retirement income, under specific conditions.

Real Estate Investments: Tax Implications and Reporting Requirements

Investing in real estate while living abroad adds another layer to the already complex scenario of expat taxes. If you own real estate in the US, you’re subject to the same tax reporting and implications as residents, including property taxes, capital gains taxes, and the possibility of rental income taxation.

Foreign real estate ownership carries its own set of rules. You’ll need to report income from foreign rental property and may be able to deduct related expenses. However, the Foreign Tax Credit (FTC) could mitigate the burden of being taxed both in the US and the country where the property is located. Understanding and applying these tax breaks effectively can significantly impact your overall tax obligation.

Remember, navigating through the intricacies of expat tax law requires continual learning and sometimes a bit of professional guidance. Whether dealing with non-resident tax implications, exploring states with favorable tax regimes, or making the most out of international living, keeping abreast of your obligations and opportunities can lead to a more financially sound expatriate life.

Overview of Puerto Rico tax system

Exploring the tax benefits in Puerto Rico reveals a landscape ripe with incentives designed for both individuals and businesses alike. As a U.S. territory, Puerto Rico offers a unique tax situation that stands apart from states with low income tax, especially for those considered non-resident taxpayers under certain criteria.

Tax Incentives for Individuals

In an effort to attract new residents, Puerto Rico introduced several tax incentives tailor-made for individuals. Notably, these incentives cater to investors and high-net-worth individuals seeking favorable tax treatment on their income. Under specific acts, such as Act 22, residents benefit from 0% tax rates on dividends, interest, and certain capital gains. This provides a compelling advantage for those looking to optimize their tax liabilities, especially when compared to mainland U.S. tax rates.

Tax Incentives for Businesses

For businesses, Puerto Rico offers equally enticing tax benefits. Various acts, including Act 20, offer reduced corporate tax rates, sometimes as low as 4%, for companies that establish and maintain operations on the island. These incentives are particularly aimed at service-oriented businesses, including technology, consulting, and medical services, promoting Puerto Rico as an attractive hub for business expansion and relocation.

Key Features of Act 20 and 22

Act 20, know as the Export Services Act, and Act 22, the Individual Investors Act, are pivotal components of Puerto Rico’s tax strategy. The primary benefit of Act 20 is a 4% corporate tax rate, among other tax advantages, if they export services outside Puerto Rico. Act 22 complements this by offering new Puerto Rican residents tax exemptions on passive income generated from interest, dividends, and capital gains.

Tax Benefits for Export Services Businesses

Focusing on export services, Act 20 was specifically designed to transform Puerto Rico into a service-based economy. Businesses under this act enjoy not only the 4% corporate tax rate but also exemptions on property taxes and tax-free dividends for Puerto Rican residents. This favorable tax regime aims to boost the island’s appeal as a global services hub.

Eligibility Criteria

Individuals and businesses must meet certain eligibility criteria to tap into these benefits. For individuals, a crucial requirement is to become a bona fide resident of Puerto Rico, which involves spending a minimum number of days on the island each year. Businesses, on the other hand, need to demonstrate that they are providing eligible services to non-Puerto Rican clients and commit to maintaining operations and employment within the territory.

Reporting Requirements

Compliance and reporting are keystones to reaping the benefits of Puerto Rico’s tax incentives. Individuals and businesses alike must adhere to precise reporting requirements to maintain their eligible status. This includes filing annual reports and tax returns specific to Puerto Rico, detailing income, expenses, and compliance with the rules governing the tax incentives. Properly navigating these requirements ensures that participants fully enjoy the tax advantages while remaining in good standing with both Puerto Rican and federal tax authorities.

Benefits of Renouncing US Citizenship

When you’re living abroad, the complexities of US tax laws don’t vanish. In fact, they can become more daunting. You may wonder about the tangible benefits of renouncing US citizenship, especially in light of tax obligations. This drastic step can seem appealing for several reasons, particularly to those who’ve made their lives permanently in another country.

Firstly, renouncing US citizenship means shedding the global tax net. Unlike most countries, the US taxes its citizens on worldwide income, regardless of where they live. By renouncing citizenship, you no longer need to file US tax returns, provided you’ve complied with all tax obligations up to the point of renunciation. This can be especially beneficial if you reside in states with low-income taxes or countries with favourable tax treaties with the US.

Another significant advantage is eliminating the need to report foreign bank accounts and assets under the Foreign Account Tax Compliance Act (FATCA). The stringent reporting requirements of FATCA can be a burden, with severe penalties for non-compliance. Renouncing citizenship frees you from this obligation, simplifying your financial reporting and potentially reducing legal and accounting fees.

Additionally, for those individuals who have established residency in territories like Puerto Rico, renouncing US citizenship might further streamline their tax situation. Puerto Rico offers unique tax incentives to residents under Acts such as Act 20 and Act 22, which provide reduced tax rates and exemptions from certain taxes for eligible individuals and businesses. However, it’s important to understand that these benefits only apply to Puerto Rico residents who are not US citizens, thus deciding to renounce a viable option for those seeking to maximize their financial benefits.

Downsides to Renouncing US Citizenship

Renouncing US citizenship can seem attractive to those seeking to reduce their tax burden, especially when living in areas with favorable tax conditions, such as Puerto Rico or states with low income tax. However, the decision carries significant financial and legal ramifications that you should carefully consider before making this life-changing choice.

First and foremost, the act of renouncing citizenship does not automatically exempt you from US taxes. If you’ve been considering Puerto Rico for its tax incentives, understand that while it offers unique benefits under Acts 20 and 22, these do not extend to non-residents automatically. Your tax obligations to the US don’t simply vanish upon renunciation; rather, you become subject to the Exit Tax or Expatriation Tax. This tax treats all your assets as if you’d sold them the day before renouncing them, potentially resulting in a hefty tax bill based on unrealized capital gains.

Moreover, the process isn’t free or instant. The US charges a significant fee to renounce citizenship, and you must comply with all tax filings for the past five years. This includes submitting a Form 8854, which serves as your final tax return, detailing all your global assets. Failure to comply can lead to being labeled a “covered expatriate,” along with further financial penalties.

Another critical consideration is the permanent renunciation of rights and privileges that come with US citizenship, including the right to live and work in the US, and access to consular protection abroad. Re-entry into the US could become markedly more difficult, requiring visas for travel that were previously unnecessary.It’s also important to think about the non-tax implications of this decision. Renouncing US citizenship is irreversible and might affect your family dynamics, access to certain jobs, and your ability to influence political change through voting or other civic duties.

Seeking Professional Assistance for US Citizens Living Abroad

Navigating the murky waters of taxation for US citizens living abroad can be daunting. With complex laws governing everything from Puerto Rico Tax regulations to handling non-resident tax obligations, it’s clear that managing your taxes isn’t a do-it-yourself kind of task. This is where professional assistance comes into play, ensuring you remain compliant with IRS regulations while optimizing your tax situation.

The Role of Tax Attorneys and CPAs for Expats

Tax attorneys and Certified Public Accountants (CPAs) specializing in expatriate taxation play a crucial role. They possess an in-depth understanding of tax treaties, the Foreign Earned Income Exclusion, and other tax benefits relevant to US expatriates. Their expertise extends to navigating states with low income tax and understanding non-resident tax nuances, making them indispensable for US citizens residing overseas. Whether it’s tackling the Puerto Rico tax code or optimizing foreign tax credits, these professionals provide personalized strategies to mitigate your tax burden.

Choosing the Right Tax Professional: Factors to Consider

Selecting the right tax professional is paramount. Here are key factors to mull over:

- Specialization: Look for professionals specializing in expat taxation, as general accountants might not be well-versed in the complexities of non-resident tax and international tax laws.

- Experience: Prioritize professionals with a robust track record of handling taxes for US expatriates, especially if you’re dealing with specific scenarios like Puerto Rico tax implications.

- Reputation: A good reputation, verified through reviews and testimonials, is indicative of reliability and quality service.

- Accessibility: Ensure they are accessible and communicate clearly, providing tailored advice and answering your concerns in a timely manner.

Benefits of Working with Experts in Expat Taxation

Outsourcing your tax needs to experts offers several benefits. Firstly, it significantly reduces the risk of errors and non-compliance, which can be costly. Professionals keep abreast of the latest tax laws, ensuring you reap all applicable benefits, such as maximizing your Foreign Earned Income Exclusion or making the most out of states with low income tax scenarios. Moreover, they can provide strategic advice on tax planning and financial decisions affecting your taxes, from investing in foreign real estate to withdrawing from retirement accounts abroad.

Working with tax professionals familiar with expatriate issues transforms a potentially stressful endeavor into a manageable task. They not only help in fulfilling your tax obligations but also ensure that your global income is taxed in the most favorable manner. With their guidance, you can focus on living and working abroad, confident that your tax situation is optimized and compliant.

In Summary: What is the Best Strategy to Pay Less Tax?

When you’re a US citizen living abroad, understanding your tax obligations and finding strategies to minimize them without breaking the rules is crucial. Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC) are two powerful tools to reduce your tax liability. Here’s a closer look at how you can leverage these while staying compliant.

Utilize the Foreign Earned Income Exclusion

The FEIE allows you to exclude a significant amount of your foreign earned income from US taxes. For the 2023 tax year, you can exclude up to $112,000 of foreign income. To qualify, you must meet either the Physical Presence Test or the Bona Fide Residence Test, demonstrating you’ve spent a substantial part of the year outside the US. This exclusion is pivotal for US expats aiming to reduce their tax bill and can be even more beneficial if you’re living in a country with low or no income tax.

Capitalize on the Foreign Tax Credit

If you’re paying income taxes in your host country, the FTC can be invaluable. This credit allows you to offset taxes paid abroad against your US tax obligation on the same income. It’s a dollar-for-dollar tax credit, meaning for every dollar of tax you pay in a foreign country, you reduce your US taxes by a similar amount, up to certain limits.

Consider States with Low Income Tax

If you maintain ties to the US, the state you’re considered a resident of can significantly impact your tax situation. Some states have low or no income tax, which can be advantageous. Establishing residency in a state like Florida or Texas, without state income taxes, can lower your overall tax burden.

Explore Puerto Rico Tax Advantages

For those looking for unique tax saving opportunities, Puerto Rico offers enticing options. Due to its unique status as a US territory, residents of Puerto Rico who earn their income within the territory can take advantage of special tax rules, potentially paying significantly lower taxes than they would on the mainland.

While these strategies can help reduce your tax bill, navigating them carefully is important to avoid pitfalls. Missteps can lead to penalties and added stress. Always ensure you’re fully informed or consult with a tax professional specializing in expatriate taxes to tailor the best tax strategy for your specific situation.

Conclusion

Navigating the complex world of taxes as a US citizen living abroad can be daunting. With the right strategies and professional guidance, you can ensure compliance with IRS regulations while minimizing your tax burden. From leveraging the Foreign Earned Income Exclusion and Foreign Tax Credit to understanding the nuances of dual citizenship and FATCA requirements, there’s a lot to consider. Remember, each situation is unique, and what works for one person may not work for another. Don’t navigate these waters alone. Reach out to experts who can help you optimize your tax strategy and safeguard your financial well-being while living the expat life.

Frequently Asked Questions (FAQ)

1. What is the Foreign Earned Income Exclusion (FEIE), and how can US citizens living abroad qualify for it?

The Foreign Earned Income Exclusion (FEIE) allows US citizens living abroad to exclude a certain amount of their foreign earnings from US income tax. For the 2023 tax year, you can exclude up to $112,000 of foreign income. To qualify, you must meet either the Physical Presence Test, demonstrating you’ve spent at least 330 full days outside of the US in a 12-month period, or the Bona Fide Residence Test, showing you’ve been a resident of a foreign country for an uninterrupted period that includes an entire tax year.

2. Can US citizens living abroad avoid paying taxes in both the US and their country of residence?

Yes, US citizens living abroad can avoid double taxation through mechanisms like the Foreign Tax Credit (FTC) and tax treaties between the US and their country of residence. The FTC allows taxpayers to credit income taxes paid to a foreign government against their US tax liability on the same income. Tax treaties may provide additional relief from double taxation. However, US citizens must file a US tax return and properly claim these benefits to avoid paying tax on the same income to both countries.

3. How does FATCA affect US citizens living abroad?

The Foreign Account Tax Compliance Act (FATCA) requires US citizens living abroad to report their foreign financial accounts and assets to the IRS if they exceed certain thresholds. This includes bank accounts, investment accounts, and certain other foreign assets. The reporting threshold is over $200,000 at the end of the tax year or more than $300,000 at any time during the year for single filers living abroad ($400,000 and $600,000, respectively, for married filing jointly). Failure to report can result in severe penalties.

4. What are the implications of renouncing US citizenship for tax purposes?

Renouncing US citizenship can relieve the individual from future US tax obligations on their global income, but it comes with immediate tax implications, such as the imposition of an Exit Tax or Expatriation Tax. This tax treats all your assets as if sold at fair market value on the day before you renounce, potentially resulting in a significant tax liability. Before renouncing, it’s crucial to settle all tax obligations up to the date of renunciation and comply with the certification requirements of tax compliance for the five years preceding the renunciation.

5. What states are best for US citizens living abroad to maintain residency for tax purposes?

For US citizens living abroad looking to maintain US residency for tax purposes, states with no income tax are preferable. These include Florida, Texas, Nevada, South Dakota, Washington, Wyoming, and Alaska. Residing or maintaining residency in these states can help minimize or eliminate state income tax obligations, as they do not tax their residents’ worldwide income. It’s important to establish bona fide residency in one of these states before moving abroad to benefit from their tax policies.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, Citizenship by Investment, The Caribbean, Investing, US Citizens Living Abroad Taxes, Puerto Rico, US Virgin Islands, Tax Treaty Network, Real Estate, Second Residence, Real Estate Investing, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship