Considering a major lifestyle change or looking for the perfect vacation home? Living in the Caribbean presents a new adventure for most, featuring a wide array of islands with distinct appeal. Whether you’re drawn to the tax advantages, stunning natural beauty, or serene beaches that epitomize Caribbean living, there’s undoubtedly an island that aligns perfectly with your desires and lifestyle preferences. This comprehensive guide is designed to help you navigate through selecting the best Caribbean islands to live in, ensuring you find a perfect place that meets and exceeds your expectations for a dream Caribbean life.

Diving deeper into what it means to embrace living in the Caribbean, this guide will explore the pros and cons of expatriate life across various Caribbean islands. From understanding the differences in living costs and community vibes to navigating the legalities of property ownership and residency, we aim to equip you with all the necessary information to make an informed decision. Whether you’re leaning towards the luxurious living of the Bahamas, the rich cultural tapestry of Jamaica, or the unspoiled natural beauty of St. Lucia, our guide to Caribbean living is here to illuminate the path to making the Caribbean your new, idyllic home.

What is it like living in the Caribbean?

Imagine waking up each day to the soothing sounds of waves and the gentle caress of a tropical breeze. That’s the everyday reality when you make the Caribbean your home. The islands are not just a picturesque backdrop for vacations; they’re vibrant communities with a relaxed pace of life that many find alluring. When you move here, you’ll notice that time seems to slow down, providing an opportunity to savour life’s pleasures in spectacular natural surroundings.

The cost of living in the Caribbean varies across the islands. While some areas are more affordable, others are known for their exclusive resorts and upscale amenities. Regardless, you’ll find that most places offer a balance between modern conveniences and unspoiled natural beauty. As you consider your options, it’s crucial to keep in mind that each island has its own cost profile, from housing and groceries to leisure activities.

For those looking to benefit financially, the term “Caribbean tax haven” might come to mind. Several islands offer tax incentives to attract foreign investment, which can be quite beneficial if you’re looking to preserve your wealth while enjoying an idyllic lifestyle. Moreover, a handful of islands have introduced Caribbean citizenship by investment programs, which provide a legal pathway to obtaining a second passport in exchange for economic contributions to the host country.

Living in the Caribbean also means immersing yourself in a melting pot of cultures. The vibrant local communities are welcoming, offering a warm culture that blends music, cuisine, and traditions from around the world. You’ll find that there’s a spirit of celebration in the air, with festivals and events that reflect the diverse heritage of the islands.

Whether you’re working remotely, pursuing new business ventures, or simply enjoying retirement, the Caribbean presents a unique way of life that balances leisure and opportunity. It’s a place where you can forge deep connections with the community, live sustainably, and embrace a sense of tranquillity that’s hard to find elsewhere.

History of the Caribbean Region

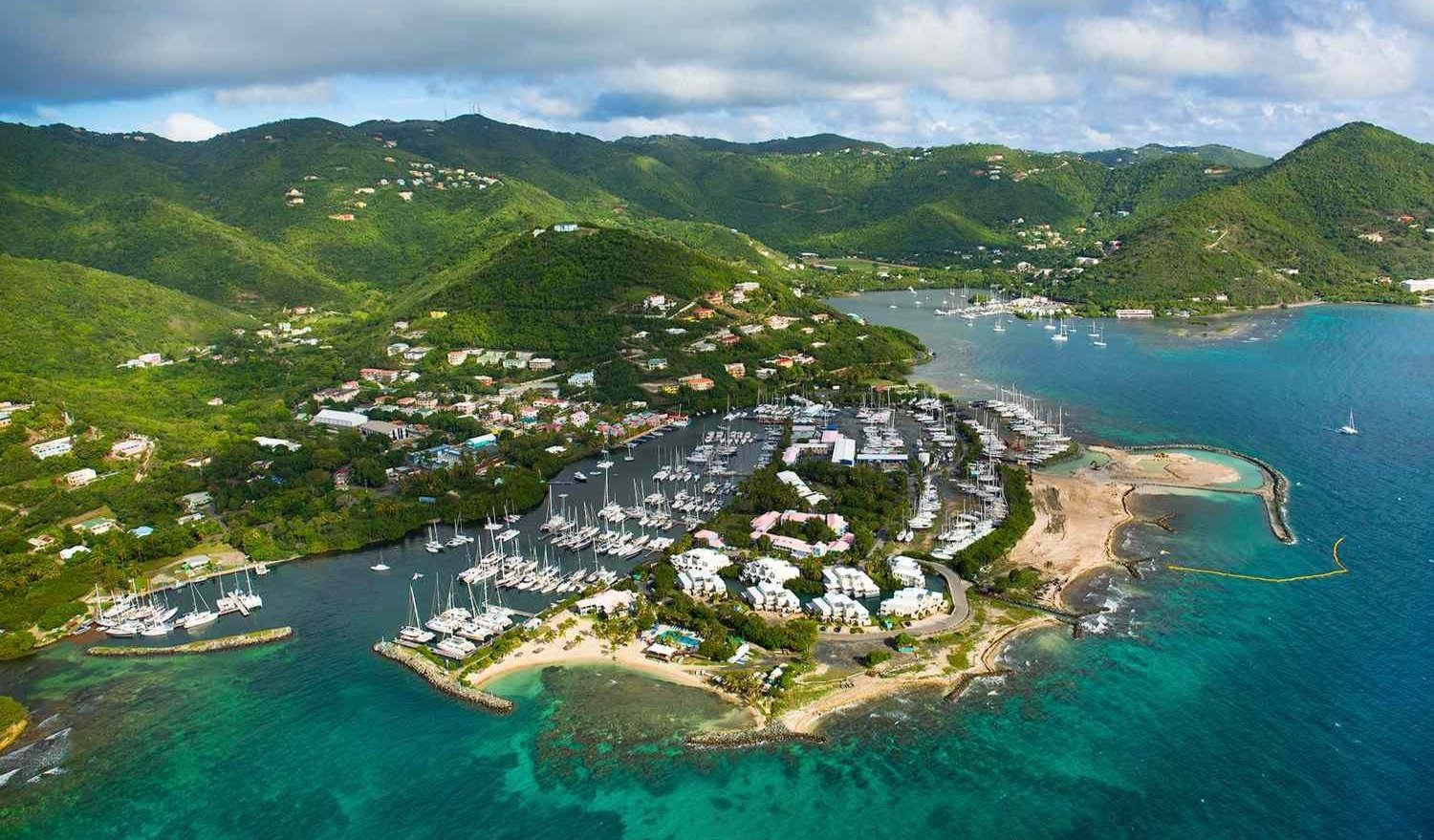

Imagine stepping onto the shores of a land rich in history; the Caribbean region is not just a picture-perfect postcard of sandy beaches and turquoise waters, but also a mosaic of historical events that have shaped it into the culturally diverse utopia you see today. This region, once bustling with indigenous communities like the Taíno and Caribs, opened a new chapter with the arrival of European explorers in the late 15th century. This marked the beginning of centuries of colonization, which introduced a transformative mix of cultures and ethnicities.

The Caribbean’s strategic location made it the focus of European powers, who quickly saw its potential not just for tax haven purposes but as a corridor for wealth. The colonization era brought the Spanish, British, French, Dutch, and later, Americans, each leaving a distinct imprint on the cultural fabric of the islands. The importation of African slaves and immigrants from India and China introduced further layers of diversity, influencing the region’s language, cuisine, music, and traditions.

During the 17th and 18th centuries, the Caribbean became an economic powerhouse by cultivating sugar cane, tobacco, and other valuable crops, which in turn propelled the sinister era of the Atlantic slave trade. The legacy of these times is apparent in the vibrant, resilient spirit of the Caribbean people and can be seen in the various forms of expression found throughout the islands.

In recent times, the Caribbean has pivoted towards harnessing its natural beauty and strategic advantages to benefit its communities. The cost of living in the Caribbean varies across the islands, reflective of both its colonial past and its present focus on tourism and financial industries. Several islands have established Caribbean citizenship by investment programs that have not only brought inward investments but also allowed individuals to enjoy the perks of the Caribbean lifestyle while benefiting from the region’s fiscal policies.

The Caribbean’s rich tapestry of history is not just a story of conquest and colonization but also a testament to the resilience and creativity of its people. Its past continues to inform its present, offering a dynamic blend of experiences for those who seek a life ensconced in the backdrop of lush mountains, clear waters, and a storied legacy.

Real Estate and Housing in the Caribbean

Market Overview

Discovering real estate in the Caribbean means exploring a market of contrast and diversity. From modest homes to extravagant estates, the allure of island living drives a dynamic housing market. Rising demand, coupled with the region’s reputation as a tax haven, ensures a continual flow of investment opportunities. Caribbean citizenship by investment programs further augments this appeal, allowing individuals to own a piece of paradise while obtaining residency or citizenship.

Affordable Caribbean Real Estate

Affordable Caribbean real estate isn’t just a dream—it’s a reality in many islands. As you seek out a cost-effective tropical haven, consider options such as Grenada and Dominica, where the cost of living in the Caribbean is low, and a moderate lifestyle is attainable for less than $650 per month. Whether you’re a retiree or a remote worker, affordable housing options can serve as your gateway to a relaxing, sun-soaked lifestyle without breaking the bank.

Gated Communities in the Caribbean

For those prioritizing security and exclusivity, gated communities provide a sanctuary with like-minded neighbours and amenities at your doorstep. These enclaves often include access to private beaches, golf courses, and fitness centers and are attractive for their managed services and community events. Besides the lifestyle benefits, gated communities enhance property values, securing your investment in the long term.

Some of the larger jurisdictions like The Bahamas, Costa Rica, Panama, Puerto Rico and more have a large selection of gated communities to choose from, where as smaller islands such as Barbados, Antigua or St. Lucia have a more limited selection.

Luxury Pre-Construction Developments

Pre-construction developments in the Caribbean started to heat up in more developed jurisdictions like the Cayman Islands and The Bahamas in the 1980s and often present a significant opportunity for investment and the potential for appreciation. These luxury projects allow buyers to customize their property and be part of burgeoning developments, securing high-end real estate at a fraction of the cost once the project is complete.

The most recent trend is starting to see smaller countries such as St. Kitts and Nevis, Antigua and Barbuda, and Barbados start attracting larger developers from Canada and the US interested in developing more remote, high-value luxury properties. These are often prices to sell and can offer good value for affluent families and investors with a long-term investment mindset.

Condo Market in the Caribbean

The condo market offers a versatile approach to island living—perfect for those seeking a low-maintenance lifestyle. Many investors find value in purchasing condos, especially in regions with robust tourism sectors. Owning a condo in the Caribbean is often associated with easier upkeep and access to community amenities, making it a popular choice for second homes or vacation rental properties.

Caribbean Land for Sale

Looking for a blank canvas to create your dream home? Several islands have land available in pristine locations—whether it’s beachfront property or elevated terrain offering panoramic views. There’s a slice of heaven for every preference, enabling you to build a custom retreat that encapsulates the essence of the island life you desire. Remember though, some islands like Roatan in Honduras restrict land purchases over a certain size to residents only—something to consider.

Currently land is the Caribbean is readily available and can offer excellent value, especially for individuals and investors who are willing to go through the process of building a new structure. But buyer beware, building a home or commercial property in the Caribbean comes with its fair share of challenges including but not limited to financing, land servicing, finding reliable trades and general contractors, municipal and fedral government bureaucracy, and more.

Flight Access and Transportation

Embracing the Caribbean lifestyle brings with it a unique set of travel considerations, particularly for high-net-worth individuals and affluent families. While obtaining Caribbean citizenship through investment offers a gateway to this tropical paradise, navigating air travel here presents a different landscape compared to the abundant and cost-effective options available in Europe or North America.

In the Caribbean, air travel, especially between islands, can be a premium experience, often carrying a higher price tag. Regular commercial flights between islands might not be as frequent or as economically priced as those in larger continents, with some journeys potentially costing several hundred dollars. Direct flights, too, are not universally available across all jurisdictions.

However, the true allure for the affluent traveler lies in the private jet experience. This mode of transportation not only circumvents the intricacies of island-hopping commercial flights but also offers a level of luxury, privacy, and efficiency that is highly valued. For example, while a commercial flight from Curaçao to Barbados might require multiple layovers and take up to six hours, a private jet can significantly reduce this time, providing a direct, swift, and more comfortable journey. This advantage becomes even more apparent when compared to international flights from major cities like New York, which can reach Caribbean destinations astonishingly faster.

For those accustomed to the highest standards of comfort and efficiency, private aviation services in the Caribbean are well-equipped to cater to these needs, offering a seamless and luxurious travel experience that complements the opulent lifestyle of the region.

Safest Caribbean Islands

When considering a move to the Caribbean, safety is just as paramount as the picturesque landscapes and tranquil beaches. The islands mentioned below are renowned for their low crime rates and secure living environments, making them top choices for expats, retirees, and investors alike.

Cayman Islands

The Cayman Islands stand out as a veritable tax haven, offering no direct taxes for residents. Caribbean Tax Haven perks extend to no income tax or capital gains tax, appealing to those seeking financial benefits along with safety. Regarded for its low crime rate, the Cayman Islands is a British overseas territory that provides a secure setting for your new home. Here, you can immerse yourself in a culture that values safety and stability without sacrificing the Caribbean’s signature lifestyle.

Antigua and Barbuda

Antigua and Barbuda promise a serene retreat, further sweetened by enticing tax incentives and their Caribbean Citizenship by Investment program. Notably one of the safest Caribbean destinations in 2020, these islands also boasted one of the lowest burglary rates and kidnapping cases. Whether you’re considering the cost of living or the quality of life, Antigua and Barbuda’s commitment to safety and community well-being is exemplary. Their reputation for safety complements the islands’ luxury resorts and breathtaking beaches, making them a magnet for those in search of peace and security.

Turks and Caicos

An archipelago known for its striking blue waters and upscale amenities, Turks and Caicos is also a tax-neutral jurisdiction. This means that not only do homeowners benefit from no annual property taxes, but they also relish in the islands’ dedication to a secure environment. The islands’ safety record is remarkable, reassuring residents and visitors alike that their stay here is as stress-free as possible. The Turks and Caicos Islands offer an idyllic setting where safety and tax incentives go hand in hand, making them a sought-after location for real estate investment and luxurious Caribbean living.

Barbados

While it’s true that Barbados displays a higher cost of living compared to some other Caribbean islands, it significantly makes up for it with its infrastructure and top-notch security standards. Both expats and locals benefit from good governance and low crime rates, ensuring that Barbados remains a top choice for those prioritizing a safe environment. With vibrant communities, excellent healthcare, and a stable political climate, Barbados stands as a beacon of safety in the Caribbean Sea.

Anguilla

Anguilla, another British overseas territory, is revered for its untouched beauty and low-profile elegance. Safety in Anguilla is one of its hallmarks, attributed in part to its small population and close-knit community. It’s a destination where you can leave your worries behind and enjoy everything the Caribbean has to offer in relative security and comfort.

St. Barths

St. Barths, officially known as Saint Barthélemy, is a French-speaking Caribbean island known for its white-sand beaches, luxury yachts, designer boutiques, and upscale restaurants. It boasts one of the lowest crime rates in the Caribbean, thanks to its small size and effective law enforcement. St. Barths is often frequented by celebrities and high-net-worth individuals seeking a private and secure vacation spot. The island’s focus on high-end tourism contributes to its safe and well-maintained environment, making it a top choice for those who prioritize security and exclusivity.

St. Kitts and Nevis

St. Kitts and Nevis, a dual-island nation, is known for its cloud-shrouded mountains and pristine beaches. Renowned for their warm hospitality and laid-back atmosphere, these islands offer a safe and peaceful environment for residents and visitors. The government’s significant investment in tourism and infrastructure has led to a stable and secure setting. Low crime rates, community policing, and a strong sense of local community contribute to the islands’ reputation as a safe Caribbean destination. St. Kitts and Nevis are particularly attractive to retirees and investors, with programs like Citizenship by Investment providing added incentives for those seeking a safe and serene Caribbean lifestyle.

By choosing one of these islands for your Caribbean home, you’re not just investing in real estate or exploring living options, you’re also choosing peace of mind in locales where safety is not an afterthought, but a pervasive aspect of everyday life.

Expat Healthcare in the Caribbean

Public Healthcare in the Caribbean

When setting your sights on a new life in the Caribbean, you’ll find that healthcare systems vary greatly among the islands. Public healthcare is accessible in most Caribbean nations. Many have at least one significant hospital, with outpatient clinics supporting the wider network. For instance, Barbados stands out for its comprehensive system, boasting the main Queen Elizabeth Hospital in Bridgetown, and supplemented by eight polyclinics and other specialized facilities.

While healthcare costs are generally lower than those in the US, you need to dig into the specifics of each island’s healthcare quality. Islands with fewer facilities typically offer more basic care, so consider this when choosing your new home. Remember, healthcare quality varies, and your research will ensure that you stay informed about the adequacy of public services. Reliable health professionals are a constant across the islands, providing trustworthy care at prices that might positively surprise you.

Private Healthcare in the Caribbean

Private healthcare options can also be a consideration for expats, often providing a level of comfort and convenience you’re accustomed to. In the Caribbean, private hospitals and clinics cater to varying needs, with some islands offering state-of-the-art facilities. If you’re weighing the cost of living in the Caribbean, factoring in private healthcare expenses is key, especially when compared to the affordability of public services.

Keep in mind, adequate insurance is crucial if you’re leaning towards private healthcare. Without it, out-of-pocket costs can escalate quickly. Exploring private healthcare options further emphasizes the importance of understanding the healthcare landscape as part of your overall due diligence. As healthcare is a central pillar of living comfortably on the islands, copious research into both public and private options is a commitment that may pay dividends in your quality of life.

While not typically associated with the concept of a tax haven, some Caribbean nations offer favorable tax conditions that may impact your financial planning, especially when considering the overall cost of living in the Caribbean. As you scout for the ideal Caribbean destination, consider that some nations also extend Caribbean citizenship by investment programs, a perk that could synergize with your lifestyle and financial goals.

Education and Schools in the Caribbean

When considering the move to the Caribbean, educational facilities for your family are of paramount importance. Whether you’re concerned about the cost of living in the Caribbean or evaluating the potential of Caribbean citizenship by investment, rest assured, the educational landscape in this region is robust and caters to a diverse range of needs.

Primary and Secondary Schools

In the Caribbean, the educational system heavily draws from British and European models, ensuring a familiar and structured learning environment. English remains the primary language of instruction, yet the cultural diversity of the area provides an ideal setting for bilingual or multilingual education. This is especially beneficial if you’re contemplating Caribbean citizenship by investment, as language skills can be a valuable asset.

The islands offer a variety of schooling options:

- Local schools with an ethos that reflects the rich cultural tapestry of their surroundings.

- International schools that follow globally recognized curricula.

- Private institutions focused on delivering a more personalized education experience.

For families eager to immerse their children in a new language, Caribbean countries excel in language immersion programs, recognized as the fastest route to language proficiency.

Post-Secondary Schools

The Caribbean is not just a tax haven with appealing fiscal incentives, it’s also a place of academic pursuit and achievement. The University of the West Indies (UWI) is a beacon of higher education within the region and is renowned worldwide. UWI has consistently earned a place among the top 600 in The Times Higher Education (THE) World University Rankings, reflecting the caliber of education on offer.

Here is a list of the top 25 post-secondary schools in the Caribbean region:

Top 25 Post-Secondary Schools in the Caribbean

| Rank | School | Location |

|---|---|---|

| 1 | University of the West Indies | Jamaica, Trinidad & Tobago, Barbados |

| 2 | University of Puerto Rico | Puerto Rico |

| 3 | Universidad Autónoma de Santo Domingo (UASD) | Dominican Republic |

| 4 | University of Technology, Jamaica | Jamaica |

| 5 | University of Curaçao | Curaçao |

| 6 | Northern Caribbean University | Jamaica |

| 7 | St. George’s University | Grenada |

| 8 | American University of the Caribbean School of Medicine | Sint Maarten |

| 9 | Universidad de Oriente (UDO) | Cuba |

| 10 | Pontificia Universidad Católica Madre y Maestra (PUCMM) | Dominican Republic |

| 11 | University of Belize | Belize |

| 12 | Cave Hill Campus (UWI) | Barbados |

| 13 | Mona Campus (UWI) | Jamaica |

| 14 | St. Augustine Campus (UWI) | Trinidad and Tobago |

| 15 | University of the Southern Caribbean | Trinidad |

| 16 | University of the French West Indies | Guadeloupe, Martinique |

| 17 | Universidad del Turabo | Puerto Rico |

| 18 | Universidad Metropolitana | Puerto Rico |

| 19 | Escuela de Artes Plásticas y Diseño de Puerto Rico | Puerto Rico |

| 20 | University College of the Cayman Islands | Cayman Islands |

| 21 | University of Trinidad and Tobago | Trinidad |

| 22 | Barbados Community College | Barbados |

| 23 | Antigua State College | Antigua |

| 24 | Dominica State College | Dominica |

| 25 | Montserrat College of Art | Montserrat |

Beyond UWI, more than 60 medical schools are spread across the islands, making it a destination for aspiring medical professionals. These institutions provide rigorous training that meets international standards.

The Caribbean provides whatever your educational needs, from primary schooling to university. Coupled with the other benefits like the cost of living in the Caribbean and the tax advantages, it’s easy to see why it’s a region that appeals to families and professionals alike.

Tax Advantages to Living in the Caribbean

Income Tax in the Caribbean

Living in the Caribbean can bring significant financial benefits, particularly when it comes to income tax. Several islands offer attractive tax incentives to residents, which often result in zero or very low income tax rates. For example, the Caribbean tax haven status of countries like the Bahamas and the Cayman Islands means that you could enjoy your earnings without the burden of a hefty income tax bill.

Tax on Foreign Income

You’ll find the no tax on foreign income policy a common thread among most Caribbean nations, especially current and former British Overseas Territories. This means that income earned outside of these countries might not be subject to local taxation – a major draw for expats and remote workers. It’s an opportunity to enhance your cost of living in the Caribbean, as more of your income remains in your pocket.

No Capital Gains Tax

Investors and property owners benefit considerably from the lack of capital gains tax in many Caribbean jurisdictions. This means that profits from the sale of real estate or investments are not eroded by taxes, making the Caribbean an alluring spot for financial growth and safeguarding your assets for the future.

No Crypto Tax

The advent of cryptocurrencies has brought new considerations for tax authorities worldwide. However, Caribbean nations have emerged as pioneers in embracing crypto, with some offering friendly regulatory environments without specific crypto taxation. This forward-thinking approach ensures that your digital asset management remains favourable under the Caribbean tax haven umbrella.

Corporate Tax in the Caribbean

Business owners looking to optimize their operations should consider the corporate tax benefits of the Caribbean. Many islands offer competitive rates, with some charging no corporate tax at all. In conjunction with Caribbean citizenship by investment programs, these tax structures make the Caribbean an ideal location for setting up or relocating your business.

Property Taxes

When it comes to property taxes, the Caribbean stands out for its investor-friendly policies. In tax-neutral jurisdictions like the Turks and Caicos, homeowners can rest easy knowing there are no annual property taxes. This further sweetens the deal for those aiming to buy property and solidify their roots in the Caribbean.

Import Duty on Goods

Your relocation or long-term stay in the Caribbean may also benefit from reduced import duties on goods. While specific rates and exemptions can vary across the islands, you’ll generally find favorable terms which can contribute to a lower cost of living. It’s one more financial advantage to weigh when considering a Caribbean lifestyle.

Opening a Bank Account in the Caribbean

Top Countries for Banking in the Caribbean

When you’re setting up your new life in the Caribbean, you’ll want to choose a country known for its robust banking industry. Top countries for banking in the region include the Cayman Islands, Bahamas, and Bermuda, often regarded as some of the world’s premier tax havens. These jurisdictions offer financial stability, strong privacy laws, and efficient customer service. Attracting a global clientele, these countries have established a competitive edge with modern banking facilities that support both personal and investment banking needs.

Securing a Mortgage in the Caribbean

Owning property in paradise is a dream for many, and securing a mortgage in the Caribbean is a feasible step towards this goal. With a variety of lenders offering competitive rates, the cost of living in the Caribbean can be managed effectively. Local banks, multinational institutions, and even specialised mortgage companies cater to foreign investors and residents. It’s essential to shop around for the best rates and consider the different mortgage products available to you, bearing in mind that some Caribbean countries also offer Citizenship by Investment programs which may include real estate options.

Best Offshore Banks in the Caribbean

The Caribbean is well-known for its offshore banking services, providing an array of benefits such as enhanced privacy, asset protection, and sometimes even more favorable tax regimes which contribute to the image of a Caribbean tax haven. Some of the best offshore banks in the Caribbean are located in jurisdictions like Saint Kitts and Nevis, Antigua and Barbuda, and the British Virgin Islands. These banks cater to international standards and offer a range of services from basic savings accounts to more complex investment and wealth management options.

Business Banking

For those looking to do business in the Caribbean, the region offers tailored business banking solutions designed to support both start-ups and established enterprises. With the fascination of a tax haven and a relatively lower cost of living in the Caribbean, businesses can capitalize on favourable tax structures and competitive corporate tax rates. Most banks offer currency conversion services, letters of credit, and Internet banking to ensure that your business needs are met efficiently. It’s vital to establish a banking relationship in your chosen Caribbean nation to navigate local regulations and seize financial opportunities that arise.

Internet Speed in the Caribbean

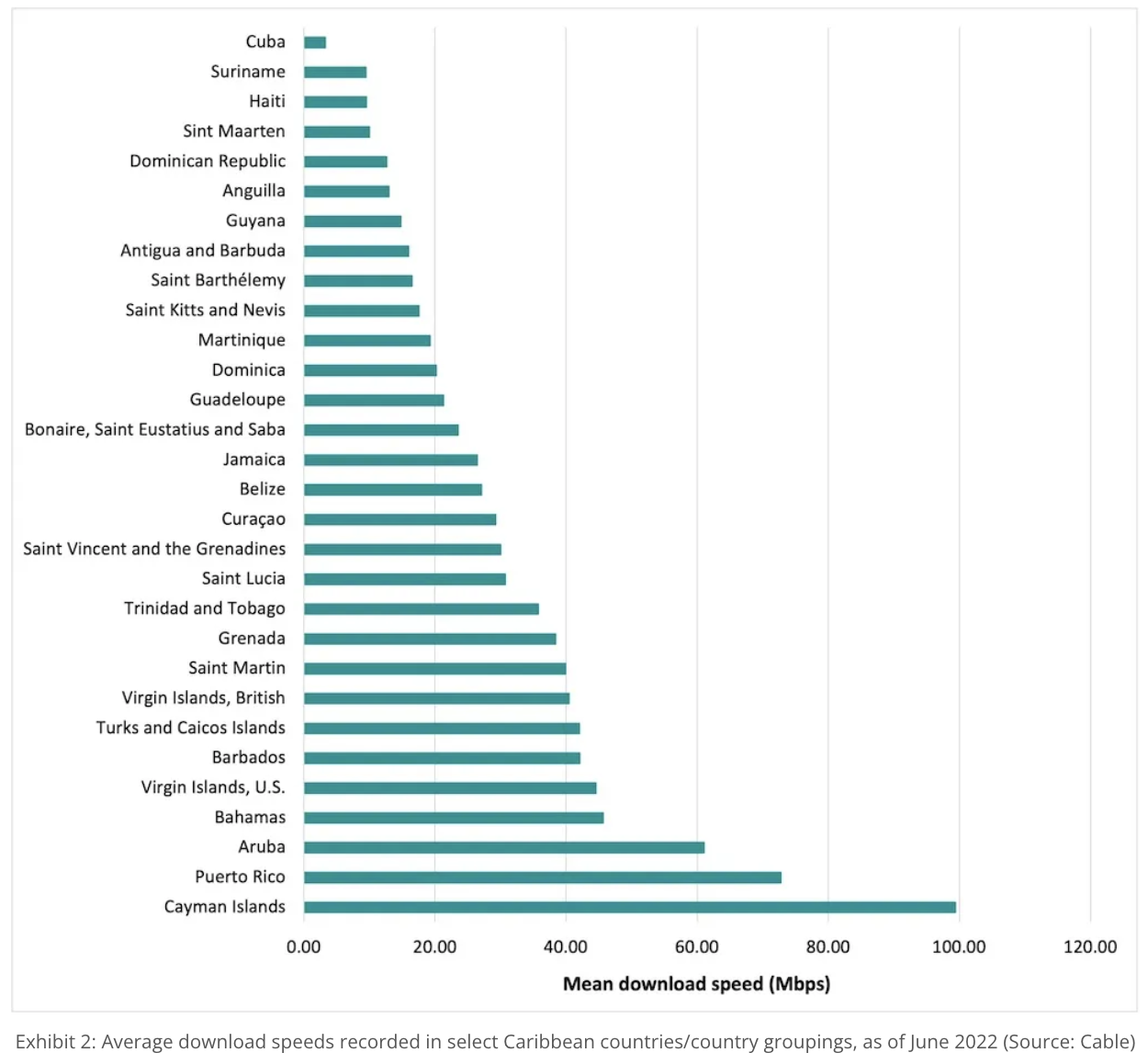

In today’s fast-paced world, staying connected is vital, especially if you’re considering making the Caribbean your home. Here, high-speed internet isn’t just a luxury; it’s a landscape of opportunity, seamlessly blending the laid-back Caribbean lifestyle with the demands of modern connectivity.

High Internet Penetration Rates & Speed in the Caribbean may come as a surprise but it’s a testament to the region’s commitment to technology and development. With 24 out of 28 Caribbean countries boasting internet penetration rates higher than the global average, you’ll find that staying in touch with the rest of the world is a breeze. In fact, over half of the islands surpass connectivity in Asia, Africa, Latin America, the Middle East, and even Oceania/Australia. If compared to another continent, Europe is the only one with some areas that are on par or exceed internet speeds in the Caribbean.

It’s not just about the coverage; let’s talk speed—the Top Ten Caribbean Islands, according to a 2020 survey by Statistica, are outpacing many countries globally. For instance, Barbados doesn’t just top the regional chart; it stood impressively at 19th out of 192 countries globally. Rapidly following are The Bahamas, St. Lucia, and Belize, not just meeting but often exceeding the necessary speeds for today’s online demands.

Education and Remote Work Facilitation go hand in hand with internet speed. Not only does the region offer an exceptionally high literacy rate and a pool of highly educated individuals, but it also ensures that students and professionals alike have the bandwidth to study and work effectively from home. This becomes increasingly relevant as the COVID-19 pandemic has shifted the norm towards online interactions, which Caribbean islands have embraced, equipping their residents with state-of-the-art information superhighways.

Getting Drivers Licence in the Caribbean

Driving through the Caribbean offers a unique way to explore the islands’ picturesque landscapes and vibrant local scenes. Each island has its own requirements for obtaining a driver’s license, and as a prospective resident, understanding these processes is essential.

To start, you’ll need to check the specific regulations of the island you’re interested in. While some Caribbean islands allow you to use an International Driving Permit (IDP) for a certain period, others require that you obtain a local driver’s license almost immediately upon establishing residency. This shift from tourist to local status often coincides with acquiring Caribbean citizenship or a residency permit.

For many islands, the process involves submitting documentation, such as your current driver’s license, passport, and proof of residency. You may also be asked to take a vision test or, in some cases, a written exam to demonstrate your knowledge of local traffic laws.

Those looking into dual citizenship through Caribbean citizenship by investment programs will be pleased to know that this also typically streamlines the process of getting a driver’s license. Once your citizenship is approved, you’ll have the same rights as any other citizen, including the ability to apply for a driver’s license without the added complications that non-citizens might face.

On the financial side, obtaining a driver’s license in the Caribbean can be relatively affordable, often mirroring the general cost of living in the Caribbean. Fees can vary, but they generally don’t pose a significant barrier to residents.

Remember, driving in the Caribbean might be a different experience than you’re used to, with varying road conditions and driving customs. Be prepared to adapt to a relaxed driving pace and local nuances in road etiquette.

Securing a driver’s license in your new Caribbean home is another step towards immersing yourself in the island life, whether you’re navigating through your daily commute or cruising along the coast to discover secluded beaches and hidden tropical treasures.

What Languages Do They Speak in the Caribbean

The Caribbean is not just a feast for your eyes with its azure waters and verdant landscapes but also a tapestry of languages, each island offering a different linguistic heritage that complements its unique culture and lifestyle.

English

As you navigate the Caribbean, you’ll discover that English is predominantly the language of business and communication, especially in territories with historical ties to the British Empire. It serves as either the official language or is widely spoken in many islands, underpinning the region’s accessibility for anglophone residents and travellers alike. Whether attending international schools, dealing with governmental procedures or interfacing with the local community, you’ll find English invaluable in your daily life. Interestingly, the influence of English extends to educational institutions, with prestigious universities like The University of the West Indies featuring prominently in international rankings, thus catering to students looking for secondary education in a familiar language.

French

The lilt of the French language graces the shores of several Caribbean islands, including Haiti, Martinique, St. Martin, and Guadeloupe. French’s romantic tones are rooted in the colonial past of these regions, bestowing upon them a European flair that continues to fascinate expatriates and investors seeking a Caribbean domicile. And it’s not just about indulging in the cultural experience; knowing French can bring practical benefits, such as easing communication in communities where it is predominantly spoken, and in particular, offering a competitive edge for professionals in the tourism and hospitality sectors.

Dutch

Though less widespread than English or French, Dutch has a significant presence in the Caribbean, most notably in the islands of Aruba, Curacao, and Sint Maarten. These islands are a melting pot where European, African and Caribbean cultures intersect. The presence of Dutch is both a nod to the colonial history and a testament to the Caribbean’s diversity. Expatriates from the Netherlands or Dutch speakers find these islands particularly accommodating, and for those considering Caribbean citizenship by investment, such linguistic diversity only adds to the allure.

Creole

For a truly immersive experience, the melodic Creole languages offer a window into the soul of the Caribbean. Creole is born of a combination of European languages and African influences, reflecting the region’s tumultuous history and resilient spirit. Papiamento, a Creole language found in Aruba, Bonaire, and Curacao, showcases a linguistic tapestry woven with threads of Spanish, Portuguese, Dutch, French, and African dialects. Understanding or even learning a few phrases in Creole enriches your cultural experience and connects you on a deeper level with the local populace, whose warm hospitality is an essential part of life in the Caribbean.

Expat Life in the Caribbean

Living in the Caribbean isn’t just a fleeting daydream—you’re selecting a lifestyle embraced by modern-day expats. With the year-round sun and a tapestry of cultures, you’re trading the ordinary for a sip of the extraordinary. Islands like Ambergris Caye and Roatán have evolved from hidden gems to bustling expat communities, mirroring the global demand for a serene island life paired with the comforts of home.

You’ll find the cost of living in the Caribbean can be an appealing change, especially if you’re moving from a city with sky-high expenses. The variation is wide between islands, and adapting to the local market prices will be part of your journey. The essentials—food, transportation, and housing—are comparably cheaper on some islands. Nevertheless, always keep in mind that living in paradise sometimes comes with a premium, particularly in the upscale areas known for luxury living.

Some islands are synonymous with the term tax haven, and for good reason. Favorable tax conditions such as no direct personal taxes make it a financially compelling destination. These benefits extend to businesses as well, many of which enjoy low to zero corporate tax rates. Such Caribbean tax havens are an alluring prospect for expats looking to maximize their financial strategies while reveling amidst splendorous backdrops.

The cost of living is one thing, but the Caribbean citizenship by investment programs are quite another. These policies enhance the allure, offering a gateway to dual citizenship through real estate investments or donations, weaving together the prospects of a new life with added international mobility. You’ll be joining a community that values the blend of secure investment opportunities with the intrinsic joy of island living.

Energy buzzes differently here. The lifestyle promotes well-being, leaving you to indulge in the simple yet profound pleasures of life. High-quality healthcare services ensure you’re in good hands, backing up the carefree island lifestyle with the reassurance of modern conveniences.

Walking along the pristine beaches, you’re not merely an expat; you’re a local in the making. Affable neighbors beckon with stories, fostering connections that anchor you to your new tropical home. Here, life is savored in a kaleidoscope of sunsets, each one bidding farewell to a day well-lived and hinting at the promise of tomorrow.

Working as an Expat in the Caribbean

Living in the Caribbean isn’t just a perpetual vacation; it’s also a place where you can pursue a flourishing career. The islands are known for embracing expats into local and multinational businesses, particularly within sectors like business services, law, and accounting. It’s true that the job market may seem tight at first glance, but the opportunities are rich and rewarding for those who possess the right skills and qualifications.

The Caribbean’s reputation as a tax haven is also a magnet for professionals. With favorable taxation rates for both individuals and businesses, you’ll find financial relief that’s hard to come by elsewhere. This financial advantage is a significant draw for companies, which, in turn, opens up job prospects for skilled expats.

While some islands offer more opportunities than others, the trend is clear across the board. The cost of living in the Caribbean is counterbalanced by the taxation policies, making it economically viable to work and enjoy the island lifestyle. Furthermore, for those looking to make a long-term commitment to living in the region, various islands offer Caribbean citizenship by investment programs. These programs not only fast-track residency but often secure a financial future with even greater tax incentives.

When eyeing the potential to work here, it’s important to tailor your job search to your overall lifestyle goals. Whether you’re looking to advance in your current career or planning to start fresh in a new industry, the Caribbean lifestyle has a place for you. With your feet in the sand and a laptop at the ready, work-life balance takes on a whole new meaning.

Lastly, remember to keep a keen eye on safety as you collaborate and connect with local and expat communities alike. While you’ll find most of the islands to be tranquil havens, staying aware and informed is key to a seamless expat experience.

Most Affordable Caribbean Islands to Live

As you continue to consider the Caribbean for your next destination, let’s delve into some of the most affordable islands where the cost of living won’t break the bank. Keep in mind, some of these islands not only offer affordability but also the added advantage of Caribbean citizenship by investment and favorable tax conditions.

Jamaica

When you think of Jamaica, images of white sandy beaches and a vibrant music scene may come to mind but affordability is also a key feature. Jamaica offers a relatively low cost of living in the Caribbean, making it a magnet for expats and retirees. You’ll find housing options that suit a modest budget, particularly outside of the tourist-heavy areas. Groceries and local services are surprisingly affordable. Moreover, with Jamaica’s connection to well-known artists and playwrights, you can immerse yourself in a thriving arts culture without the steep price tag attached to more expensive destinations.

Dominican Republic

The Dominican Republic stands out as an affordable Caribbean gem. It’s not just about the breathtaking beaches—it’s the lower cost of living that attracts many people to its shores. You can lead a very comfortable life with a monthly budget that allows for leisure and wellness activities. The island’s government has also implemented policies aimed at attracting foreign investment, including Caribbean citizenship by investment programs, which could be beneficial if you’re seeking to establish deeper roots in the island’s sandy soils. Whether you’re sipping a cocktail on a beachside bar in Las Terrenas or golf carting around Isla Mujeres, the Dominican Republic makes island living accessible.

Costa Rica

Costa Rica, while not an island, is often included in discussions about living in the Caribbean due to its eastern coast that stretches along the Caribbean Sea. It’s renowned for not just its biodiversity and eco-tourism but also for being a tax haven for retirees. The cost of living can vary, but many expats enjoy a high quality of life without an extravagant budget. Areas like Limón offer a more affordable Caribbean lifestyle with the added perk of stunning natural surroundings.

Mexico

Mexico’s Caribbean coast is epitomized by the Riviera Maya, home to destinations like Cancún and Tulum. However, quieter spots like Isla Mujeres offer a more affordable cost of living while retaining the same tropical allure. As mentioned by International Living, a couple can live comfortably on a budget of $2,000 to $3,000 a month, including rent. Mexico’s ease of residency for expats, combined with a cost of living that’s a fraction of what you’d find in many US destinations, makes it an appealing choice for many seeking a tropical lifestyle on a budget.

Panama

Your Caribbean journey might not be complete without considering Panama, known for its strategic location and as a Caribbean tax haven. Cities like Bocas del Toro provide a laid-back Caribbean experience at a fraction of the cost you might incur elsewhere. With its pensionado program, Panama offers attractive benefits to retirees, which includes discounts on entertainment, transportation, and healthcare. The living costs coupled with these benefits make Panama an enticing option for those looking to enjoy the Caribbean ambiance without the associated high expense.

By exploring these destinations, you’ll find that the dream of living in the Caribbean could be more attainable than you initially thought. The combination of affordability, tax advantages, and the possibility of obtaining citizenship through investment makes these locations worth considering for a long-term stay or even a permanent move.

Best Countries to Live in the Caribbean for Wealthy Expats

The Cayman Islands

The Cayman Islands stand out as a prime choice for those searching for a developed country complemented by robust financial services. Globally acclaimed as a Caribbean tax sanctuary, this British Overseas Territory offers an enticing benefit for residents — the absence of direct taxes. This feature elevates the Cayman Islands beyond just a financial hub; it’s a haven for the affluent, boasting an array of luxury properties, exceptional healthcare facilities, and a close-knit community of expatriates. This fiscal advantage is coupled with a lifestyle defined by safety, state-of-the-art infrastructure, and ample networking opportunities. Additionally, the excellent educational system makes it an especially appealing destination for families.

Currently, the Cayman Islands are the preferred choice for high-net-worth Canadian families, marking it as an idyllic locale for individual investors and those seeking a secure and prosperous environment for their families. This blend of fiscal benefits and high living standards positions the Cayman Islands as a top-tier destination for expatriates in the Caribbean.

The Bahamas

If living close to the US is important, then the Bahamas could be your ideal Caribbean escape. Renowned for its exquisite beaches and high-profile residents, this archipelago offers desirable real estate options, albeit at a premium. The Bahamas prides itself on being welcoming and safe for expats, along with presenting attractive options for Caribbean citizenship by investment. The cost of living might reflect the islands’ upscale offerings, but the absence of income tax compensates for this aspect considerably.

Like Cayman, the Bahamas is one of the most developed countries in the Caribbean, with world-class amenities, a sophisticated healthcare system, and a robust education sector. Its infrastructure is designed to cater to its diverse residents’ leisure and business needs, blending luxury with convenience. The islands’ connectivity, in terms of digital infrastructure and direct flights to major cities in the US and Canada, makes it an ideal location for those who desire a tropical lifestyle without losing touch with North American amenities.

Barbados

Barbados strikes a balance between a luxury destination and a culturally rich island. With a reputation for having one of the most stable economies in the Caribbean, it’s attractive for expats who can enjoy a relatively good cost of living paired with access to high-quality amenities. Since the 1980s, when Barbados agreed to a tax treaty with Canada, this small island in the Eastern Caribbean has been a hotspot for Canadian expats and businesses looking for a tax-efficient base. The treaty has fostered a strong relationship between the two countries, encouraging a steady influx of investment and expatriation. This economic alliance has contributed significantly to the island’s development, making Barbados a hub for international business within a paradisiacal setting.

The island’s allure extends beyond its fiscal advantages. Barbados boasts a rich natural landscape, pristine beaches, and a thriving cultural scene. The local community is known for its hospitality and vibrant traditions, offering expats an immersive experience of Barbadian life. From the bustling streets of Bridgetown to the serene beaches of the Platinum Coast, the island offers a diverse range of activities and experiences. Moreover, Barbados is recognized for its strong emphasis on education and healthcare, ensuring its residents’ high quality of life.

Antigua and Barbuda

For those seeking a tropical paradise in the Caribbean to live and invest, Antigua and Barbuda should be on your radar. This dual-island nation isn’t just about sun-drenched beaches—it’s also about financial perks and global mobility. Out of the 5 islands that offer Caribbean citizenship by investment, Antigua’s is one of the most straightforward pathways to securing a second passport, with significant benefits like minimal taxation for potential business endeavours.

Beyond the financial incentives, Antigua and Barbuda offer a unique blend of natural beauty, cultural richness, and recreational activities. The islands are famous for their 365 white-sand beaches — one for every day of the year — crystal-clear waters, and vibrant marine life, making them a paradise for beach lovers and water sports enthusiasts alike. The thriving tourism industry has led to the development of world-class resorts, gourmet restaurants, and a variety of entertainment options, enhancing the islands’ appeal to expats seeking a high-quality lifestyle.

Antigua and Barbuda’s commitment to sustainability and environmental preservation adds to its allure. The government actively promotes eco-friendly practices, ensuring that the islands’ natural beauty is maintained for future generations. This focus on sustainability resonates with expats who are environmentally conscious and wish to live in harmony with nature.

All these factors combined — the ease of gaining citizenship, the low tax environment, the stunning natural environment, the sustainable practices, and the rich cultural tapestry — make Antigua and Barbuda an attractive destination for those looking to relocate to the Caribbean.

Turks and Caicos

The lifestyle in Turks and Caicos is characterized by its laid-back elegance and high-end amenities. The islands cater to a discerning clientele from luxury resorts and private villas to gourmet dining and exclusive clubs. This level of sophistication extends to the island’s infrastructure, which includes modern healthcare facilities and international schools, ensuring a comfortable living experience for expats and their families.

The archipelago is also renowned for its pristine beaches, crystal-clear turquoise waters, and spectacular coral reefs, making it a world-class destination for diving, snorkelling, and other water sports. Moreover, the Turks and Caicos community is welcoming and diverse, with a rich cultural heritage that reflects a blend of indigenous, African, and European influences. The local culture is celebrated through music, art, and festivals, allowing expats to immerse themselves in a vibrant social scene.

Turks and Caicos, similar to the Cayman Islands are considered a tax-neutral jurisdiction where the term “tax burden” becomes obsolete. Here, homeowners enjoy no annual property tax and relish living in one of the most exclusive Caribbean tax havens. The cost of living aligns with the islands’ luxurious lifestyle, making it suitable for wealthy expats. Plus, the citizenship by investment avenue in Turks and Caicos stands out for its quick process and favourable tax conditions.

The combination of fiscal advantages, natural splendour, luxury living, and cultural richness makes Turks and Caicos an ideal destination for expats seeking a high-quality life in a Caribbean tax haven. This unique blend of features positions Turks and Caicos not just as a place to reside but as a lifestyle choice for those seeking the ultimate Caribbean experience.

St. Barths

St. Barths, where French elegance meets Caribbean lifestyle, is an island famed for attracting the rich and famous. Beyond its celebrity allure, it appeals to affluent expats due to its safe environment, high-end amenities, and strict property standards. The island’s allure is further enhanced by its distinct European charm, sophisticated French culture, and a remarkably low crime rate. Renowned for chic boutiques, exquisite French cuisine, and a dynamic nightlife, St. Barths offers a lifestyle that perfectly balances luxury and laid-back island living. This blend of Caribbean and French influences is also evident in the island’s architecture, characterized by stylish villas and quaint cottages, many with stunning sea views.

The island’s untouched beaches, clear waters, and verdant hills captivate, making it a paradise for beach lovers and yachting enthusiasts. St. Barths’ harbours, frequented by the world’s most opulent yachts, and its tranquil beaches provide a sanctuary for those seeking peace and privacy. Despite its modest size, St. Barths exudes a cosmopolitan atmosphere buoyed by a vibrant community spirit. A packed calendar of cultural events, music festivals, and regattas offers residents plenty of entertainment and socializing opportunities, contributing to the island’s unique and diverse cultural tapestry.

St. Barths is ideal for ultra-high-net-worth families and individuals who value safety, a high standard of living, and quality education, thanks to its excellent healthcare facilities and international schools. The cost of living, while on the higher side, mirrors the quality and exclusivity that St. Barths delivers. In essence, St. Barths is a unique destination that combines the relaxed vibe of the Caribbean with the sophistication of French living, making it a highly desirable location for expats seeking the best in both worlds.

Puerto Rico (US Citizens Only)

U.S. citizens seeking a blend of Caribbean charm and American familiarity will find Puerto Rico an ideal destination. The island, a U.S. territory, offers a unique tax incentive through Acts 20 and 22, attracting investment and residency with significant tax advantages. These benefits and a reasonable cost of living present a financially attractive option for those looking to enjoy a tropical lifestyle while optimizing their finances. The cost-effective living, coupled with U.S. legal and monetary systems, makes it a practical choice for expatriates.

Beyond economic perks, Puerto Rico is enchanted with its vibrant culture, breathtaking natural beauty, and welcoming community. The island boasts diverse activities, from exploring rainforests and pristine beaches to enjoying cultural festivals and historical landmarks. The seamless blend of American and Caribbean influences creates a comforting familiarity for U.S. expats, offering a unique living experience that combines the ease of home with the allure of an island paradise.

Puerto Rico’s infrastructure, including healthcare, education, and transportation, adheres to U.S. standards, easing the transition for expatriates. High-quality healthcare services, various educational institutions, including bilingual schools, and convenient travel to and from the mainland U.S. enhance its appeal, particularly for families. With these advantages, Puerto Rico is a top choice for U.S. citizens looking for an affordable Caribbean lifestyle without forgoing the conveniences and benefits of American life.

Digital Nomad Visas Programs for Caribbean Living

The allure of the Caribbean as a tax haven and its lifestyle appeal has led to a rise in the availability of digital nomad visas. These visas provide a unique opportunity to enjoy the low cost of living in the Caribbean while benefitting from the connectivity and flexibility needed to work remotely.

The Barbados Welcome Stamp

With the introduction of the Barbados Welcome Stamp, Barbados has positioned itself as a compelling destination for digital nomads. You can apply for a 12-month visa, allowing you to live and work remotely on this idyllic island. Notably, Barbados is recognized as a tax haven, offering fiscal advantages that might allow you to optimize your tax situation.

The “Live It” Program in St. Lucia

St. Lucia’s “Live It” Program invites you to experience island life while working remotely. This program allows a stay up to a year, and as part of the Caribbean citizenship by investment offerings, it might be your stepping stone to more permanent residency options.

Antigua Nomad Digital Residence Visa

The Antigua Nomad Digital Residence Visa offers remote workers and their families a chance to live in Antigua for up to two years. As a Caribbean tax haven, Antigua provides significant fiscal benefits, which could prove advantageous if you want to optimize your earnings while soaking up the sun.

Work in Nature Visa in Dominica

Dominica’s Work in Nature (WIN) Visa lets you enjoy the island’s natural beauty for up to 18 months. Beyond the stunning surroundings, Dominica’s citizenship by investment program could eventually lead to even greater perks, including the tax benefits associated with Caribbean nations.

Global Citizen Concierge Program (Cayman)

The Cayman Islands’ Global Citizen Concierge Program offers a novel pathway for high-earning remote workers and digital nomads. Stay for up to two years in an environment known for being a tax haven and enjoy the financial perks that come with residing in the Caribbean.

Extended Access Travel Stay in The Bahamas

The Bahamas invites digital nomads to apply for their Extended Access Travel Stay program, allowing a temporary residency for up to a year. The Bahamas’ reputation as a Caribbean tax haven ensures you enjoy the pleasures of island life without the worry of heavyweight taxation.

Work From Bermuda Certificate

Imagine living a year in Bermuda, where you can balance work and leisure effortlessly with the Work From Bermuda Certificate. As an added benefit, Bermuda’s status as a tax haven can potentially make your stay financially as pleasant as the turquoise waters.

Remote Work Stamp in Montserrat

Montserrat’s Remote Work Stamp is designed for individuals or business owners looking to relocate their work to this serene Caribbean island. Montserrat allows you to embrace a slower pace without sacrificing your professional goals.

Home Visa in Curaçao

Curaçao’s Home Visa caters to the growing digital nomad community, giving you the opportunity to work remotely from this vibrant island for six months with the possibility of an extension. Curaçao also offers tax advantages typical of Caribbean tax havens, making it an attractive spot to both live and work.

Caribbean Citizenship by Investment

St. Kitts and Nevis Citizenship by Investment

If you’re considering the Caribbean as your next home, St. Kitts and Nevis offer an attractive citizenship by investment program, one of the oldest in the world. Invest in real estate for personal use, such as a private dwelling house or a one-family condominium, starting at $400,000. Remember, this property can’t be sold for five years after obtaining citizenship, ensuring your investment is stable and secure. St. Kitts and Nevis isn’t just a tax haven but a place where you can embrace a luxury lifestyle at a competitive cost of living in the Caribbean.

St. Lucia Citizenship by Investment

St. Lucia is another stunning option for Caribbean citizenship by investment. Known for its majestic mountains and clear blue waters, investing in St. Lucia is more than a financial decision—it’s a lifestyle choice. With a daily living cost excluding rent and utilities below $700, your life here can be as extravagant or as modest as you prefer. In addition to the financial benefits, you’ll enjoy a vibrant culture and ample business opportunities in a Caribbean tax haven.

Antigua and Barbuda Citizenship by Investment

If you are looking for a destination that combines beach life with cultural richness, Antigua and Barbuda’s citizenship by investment program may be your answer. This twin-island nation is renowned for 365 beaches—one for every day of the year—and offers citizenship in exchange for an investment in real estate or a contribution to the National Development Fund. The cost of living in Antigua and Barbuda is also similar to that of St. Lucia, allowing you to enjoy an exquisite standard of living without the financial burden.

Grenada Citizenship by Investment

Grenada, often called the “Spice Isle,” offers more than just aromatic nutmeg and lush rainforests. It’s among the most affordable Caribbean islands to live on and its citizenship by investment program provides you a straightforward route to becoming a Grenadian citizen. With a moderate lifestyle possible on less than $650 per month, excluding rent and utilities, you’ll find Grenada is a cost-effective Caribbean tax haven.

Dominica Citizenship by Investment

Dominica’s citizenship by investment program is especially appealing due to its affordability and focus on eco-friendly living. Here you can lead a comfortable life surrounded by natural beauty, with modest monthly expenses amounting to less than $650. Dominica presents an opportunity for those looking to live sustainably while benefiting from the island’s generous tax advantages. Its thriving community reflects a true melting pot of cultures, adding another layer to its extensive list of advantages.

Caribbean life offers a tapestry of experiences across various islands, each with its unique allure for potential citizens. Whether you’re chasing fiscal perks in a tax haven or dreaming of an island with a low cost of living, the Caribbean citizenship by investment programs provide paths to make those dreams a reality.

Residence by Investment in the Caribbean

Cayman Islands Investor Program

In the Cayman Islands, tax haven perks are particularly appealing. As a British Overseas Territory, it boasts no direct taxation, making it an ideal locale for those seeking financial privacy and efficiency. Beyond the idyllic beaches, the Cayman Islands offer a Residency by Investment program that allows you to invest in local real estate and businesses. By investing a minimum of $1.2 million ($2.4 Million for the fast-track program), you can enjoy a high quality of life and become a permanent resident in one of the ultimate Caribbean tax havens.

Barbados SERP Program

Barbados, known for its SERP (Special Entry and Residence Permit), invites professionals from around the globe to work remotely on its shores for up to a year. This visa aligns perfectly with the Cost of Living in the Caribbean, allowing you to enjoy a balanced Caribbean lifestyle where work and pleasure coexist. The Barbados Welcome Stamp has been a beacon for digital nomads and investors seeking a temporary tax haven with the added benefit of sun, sea, and sand.

The Bahamas Residency by Investment

The alluring archipelago of The Bahamas offers a residency program that may lead to citizenship. With its stable economy and no income, sales, or inheritance taxes, it’s a desirable spot for those looking to relocate. Your investment of $750,000 in real estate qualifies you for permanent residency, and with it, the luxury of calling this Caribbean tax haven home while being surrounded by some of the world’s most beautiful waters.

Antigua and Barbuda Tax Residency Program

Antigua and Barbuda draw attention with their tax residency program, appealing to entrepreneurs and affluent families alike. The unadvertised program is one of the quickest routes to tax residency in a low-tax jurisdiction. With an annual flat tax of $20,000 annually, you can live, work, and set up banking in one of the most attractive Caribbean nations. Antigua and Barbuda is known for its laid-back and safe Caribbean life. You are starting to see a niche form in Antigua, especially attracting affluent families in their 30s and 40s with young children from Canada, the UK, and some Americans.

Anguilla Residency by Investment

Quaint and serene, Anguilla is a British Overseas Territory that emerges as another tax haven in the Caribbean. This island provides residency through property investments starting from $750,000. Offering a low Cost of Living in the Caribbean, Anguilla presents itself as a tranquil oasis for those looking to escape the hustle of city life while benefiting from its light tax structure.

Panama Residency by Investment

While not typically considered part of the Caribbean, Panama’s proximity and its Friendly Nations Visa program make it a noteworthy mention. An investment of as little as $150,000 in real estate or a local fixed deposit account can grant you permanent residency. Coupled with a competitive Cost of Living in the Caribbean and a burgeoning international business scene, Panama stands as a beacon for those seeking stability and growth in Latin America.

Conclusion: Is moving to the Caribbean a good idea?”

Embracing the Caribbean lifestyle isn’t for everyone. Everything in the Caribbean takes time, and except for a few expensive jurisdictions like Cayman or The Bahamas, the Caribbean lacks infrastructure, amenities, and even safety and security compared to places in Europe or North America. But if you’re seeking a cost-effective haven or an upscale retreat, there could an island tailored to your needs. And let’s not forget the financial perks—tax incentives and citizenship programs are just the cherries on top of this sun-kissed paradise. So if you’re drawn to a life where history and modern luxury intertwine amidst a backdrop of natural beauty, the Caribbean is calling your name.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, Citizenship by Investment, The Caribbean, Living in the Caribbean, Caribbean Life, Second Residence, Caribbean Living, Real Estate Investing, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship