Overview

The Caribbean region, renowned for its serene beaches and favourable tax regimes, stands out as a prime destination for those seeking to minimize their tax liabilities. Knowing the best countries with the lowest taxes in the Caribbean is useful for wealthy families and investors considering relocating to optimize their financial plan. This guide offers insights and highlights the top countries for living and investing in the Caribbean. Each option offers unique tax reduction advantages, lifestyles, and even enticing residence and citizenship by Investment programs.

The selection of Caribbean nations detailed herein showcases the financial benefits of low-tax jurisdictions and highlights the quality of life and accessibility that these countries provide. With developed infrastructures, stable economies, and vibrant cultures, places like The Bahamas, Costa Rica, Panama, and Barbados offer a blend of leisure and fiscal prudence, making them highly sought-after by tax-conscious expatriates and investors.

History of Tax Havens in the Caribbean

Since before its independence from the UK in the 1960s, the Bahamas was one of the original tax havens, capitalized on its no-tax regime, drawing in those seeking financial discretion and tax efficiency. Meanwhile, the Cayman Islands have set the gold standard for offshore financial services, with a well-developed sector that lacks direct taxes like income or capital gains tax. Beyond these well-known locales, the Caribbean is dotted with numerous other territories, each offering unique tax advantages, yet many remain under the radar, waiting to be discovered by savvy investors and wealthy individuals looking for tax optimization opportunities.

British Overseas Territories

The British Overseas Territories in the Caribbean, such as the Cayman Islands and the Turks & Caicos, have a long history as tax havens. These territories leveraged their status to develop sophisticated financial services sectors, attracting global capital through favourable tax regimes and strong privacy laws. The absence of direct taxes like income or capital gains tax has made them attractive destinations for international businesses and wealthy individuals seeking tax efficiency.

Former British Overseas Territories

The Caribbean is renowned for its array of countries with the lowest taxes, offering significant advantages to those seeking financial efficiency and privacy. The former British Overseas Territories such as Antigua and Barbuda, Barbados, and St. Lucia stand out for their unique blend of historical heritage and modern fiscal policies. These nations have leveraged their independence to establish compelling tax regimes that attract wealthy individuals and investors worldwide.

Antigua and Barbuda’s no personal income tax policy and attractive Citizenship by Investment program, Barbados’s favourable tax treaty with Canada and its appealing corporate tax rates, and St. Lucia’s absence of capital gains tax and its Citizenship by Investment opportunity exemplify the strategic approaches these countries have adopted to become leading destinations for those seeking the financial benefits of living or investing in countries with the lowest taxes. The blend of their rich histories, strategic tax policies, and vibrant cultures underscores their appeal and highlights the Caribbean’s overall allure as a premier destination for tax optimization.

French Territories and Overseas Collectivities

French Caribbean territories follow France’s taxation principles but often have adjusted policies to encourage economic development. Although not traditional tax havens, they offer tax incentives for investment in tourism and other sectors. These territories balance adhering to European Union standards and providing a competitive environment for business and investment. Some of the most popular tax friendly jurisdictions include St. Barths, Saint Martin, and French Guyana.

Former Spanish Territories

Once under Spanish rule, countries like Panama, Puerto Rico, Costa Rica, and more have crafted tax policies to attract foreign investment and retirees. With incentives such as reduced property taxes and exemptions from income tax on foreign sources for new residents, these nations blend their rich history and culture with appealing financial benefits, making them attractive for those seeking a mix of lifestyle and tax planning opportunities. Puerto Rico is especially attractive for US investors and entrepreneurs .

Countries in the Caribbean with the Lowest Taxes

This unique aspect of the Caribbean is especially attractive to wealthy individuals and investors worldwide, drawn to the favourable tax regimes many of these island nations offer. From the pure tax haven status of the Cayman Islands to the burgeoning financial services of Barbados, the Caribbean presents a diverse array of tax optimization opportunities. These nations, leveraging their legislative frameworks and international agreements, have established themselves as leading destinations for tax efficiency, privacy, and financial growth.

Here are the most attractive countries in the Caribbean for affluent families and investors:

Cayman Islands

The Cayman Islands are a British Overseas Territory located in the western Caribbean. Considered the “Gold Standard of Offshore,” The country has a well-developed financial sector and is regarded as one of the world’s largest offshore financial centers. The Cayman Islands is a pure tax haven with a low tax regime and no direct taxes, such as income tax, capital gains tax, or inheritance tax. Instead, the government relies on indirect taxes, such as import duties and tourism taxes. This tax system makes the Cayman Islands an attractive location for families looking to minimize their tax burden.

What makes this location ideal for wealthy families is that compared to the other countries with the lowest taxes in the Caribbean, the Cayman Islands is the most developed of all Caribbean nations, has excellent flight access from the US and Canada and also boasts some of the best healthcare in the region. All of this comes at a high price tag, but in the offshore world, you get what you pay for.

Turks & Caicos

Turks & Caicos is a British Overseas Territory located in the Atlantic Ocean and has become a very popular place to relocate for Canadians and Americans. The country has a stable and growing economy is known for its beautiful beaches and high-end tourist resorts. Turks & Caicos has a low tax regime, with no personal income, corporate, or capital gains tax. The country also has no inheritance tax or property tax. Instead, the government relies on indirect taxes, such as customs duties, to generate revenue. Although less developed than the Cayman Islands, Turks & Caicos is a convenient destination for families looking for tax reduction strategies and the Caribbean living in a safe and beautiful paradise.

Antigua & Barbuda

Antigua & Barbuda is a small island nation located in the eastern Caribbean. Still somewhat off the radar for most, this island nation is known for its stunning beaches and laid-back vibes. Antigua & Barbuda has a tax regime with no personal income tax, capital gains tax or tax on dividends. Although Antigua does have a 25% corporate tax, with proper structuring, this only applies to income produced or “earned” within Antigua and Barbuda. Foreign-sourced dividends and investment income are exempt. Instead, the government relies on indirect taxes, such as value-added and tourist taxes, to generate revenue.

Antigua is also one of only 5 Caribbean nations and a few more countries worldwide that offer Citizenship by Investment. They also offer a relatively unknown yet attractive flat-tax program. This allows certain individuals to acquire a tax identification number for as low as US $20,000 per yer with a low minimum stay requirement. Compared to other countries with the lowest taxes in the Caribbean, Antigua & Barbuda is an up-and-coming destination for HNWI families and investors looking to relocate, especially from Canada, the UK, or Europe.

The Bahamas

The Bahamas is a small island nation located in the Atlantic Ocean. The country is known for its stunning beaches, high-end tourist resorts, and vibrant nightlife. Like the Cayman Islands, The Bahamas is a pure tax haven known as a low-tax regime since its independence in the 1960s. The Bahamas has no personal income, corporate, or capital gains tax. The country also has no inheritance tax or property tax. The government relies on other taxes, such as sales and tourist taxes, to generate revenue. This tax reduction system makes The Bahamas an attractive destination for Caribbean living, especially for families looking to minimize their tax burden.

Americans have historically frequented the Bahamas, which is as little as 50 miles off the coast of Miami. Most would agree it has a very American feel, especially in Nassau, The Bahamas’ most populated island. Although Americans can’t take full advantage of the tax advantages in The Bahamas without renouncing their passports, it is still a very attractive destination for US citizens to own real estate and set up businesses.

Costa Rica

Costa Rica is a Central American country located between Panama and Nicaragua. Some would describe Costa Rica as the “Switzerland” of Central America. The country is known for its lush rainforests, beautiful beaches, and stable democracy. It’s become a hotspot for Canadians and Americans looking to live affordably in paradise.

Costa Rica has a low tax regime, with personal income tax rates ranging from 10% to 35%. It is also a territorial tax country, meaning foreign-sourced dividends and investment income can be exempt from tax with the proper structuring. Despite being one of the countries with the lowest taxes in the region, Costa Rica still has a relatively high tax burden compared to the Caribbean countries listed above. However, the country’s stable democracy and beautiful natural scenery make it a popular destination for families looking to live in the region.

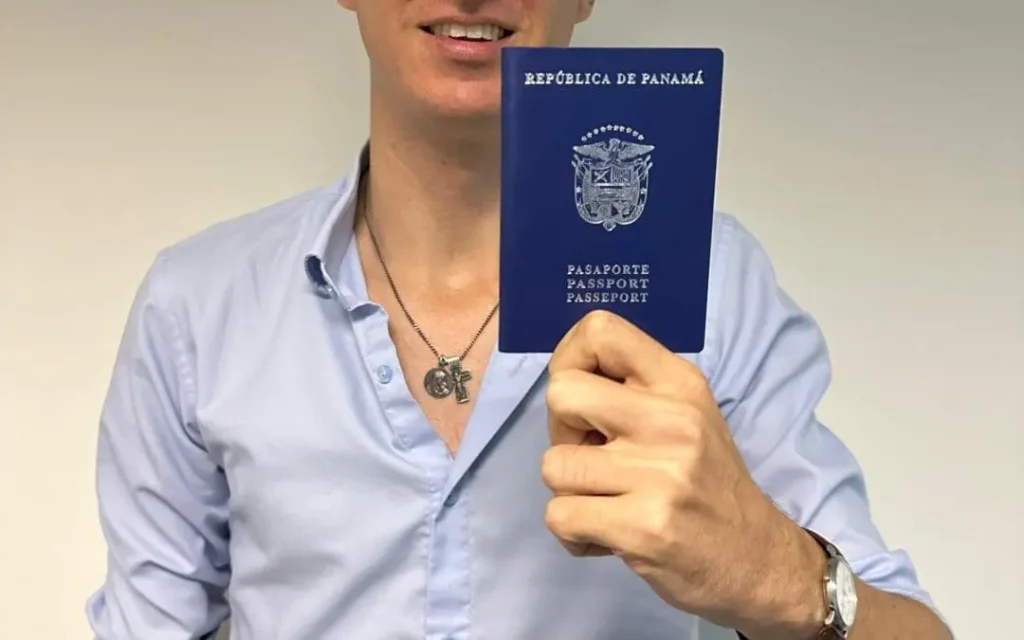

Panama

Panama is a Spanish-speaking country in Central America located between Costa Rica and Colombia. It is famous for the Panama Canal, built by the Americans, which links the Atlantic and Pacific oceans. This country has a fascinating history and was formerly part of Columbia before the Americans supported a “revolution” to an independence movement.

The country is known for its thriving financial sector and is quickly becoming a popular place for Spanish-speaking HNWIs to live, invest and park money. With proper structuring, this stable country has a low tax regime, with personal income tax rates ranging from 0% to 15%. The country also has a value-added tax of 7%. Panama’s low tax regime and well-developed financial sector make it an attractive destination compared to other countries with the lowest taxes in the Caribbean. Panama right now is especially attracting wealthy Spanish-speaking families from all over Latin America looking to minimize their tax burden.

Barbados

Barbados is a small island nation located in the eastern Caribbean. The country is known for its stunning beaches, vibrant culture, and well-developed financial and insurance sector. Barbados has a low tax regime, with personal income tax rates ranging from 0% to 30% and corporate rates ranging from 5.5% to 1%. With proper structuring, wealthy ex-pats living in Barbados pay a small yearly flat tax of US $10,000 — $20,000 on most foreign-sourced income.

In the 1980s, Barbados and Canada signed a tax treaty making Barbados a defacto extension of the Canadian economy. This attracted many businesses from Canada looking for tax reductions and the benefit of a highly educated labour force. Although many rules have changed, and other low-tax jurisdictions have double taxation treaty agreements with Canada, Barbados remains a popular destination for Canadians. The country’s stable economy, developed banking sector, excellent flight access, beautiful natural scenery, and vibrant culture make it a desirable destination for Canadian and British families looking to live in the Caribbean region.

Country Tax and Living Standard Overview

| Country | Personal Income Tax Rate | Capital Gains Tax Rate | Corporate Tax Rate | Human Development Index | Cost of Living |

|---|---|---|---|---|---|

| Cayman Islands | 0% | 0% | 0% | 0.877 | High |

| Turks & Caicos | 0% | 0% | 0% | 0.873 | High |

| Antigua & Barbuda | 0% | 0% | 25%* | 0.826 | Moderate |

| The Bahamas | 0% | 0% | 0% | 0.820 | High |

| Costa Rica | 10% – 35% | Varies | 30% | 0.806 | Moderate |

| Panama | 0% – 25% | 0% | 25% | 0.820 | Moderate |

| Barbados | 0% – 30% | 0% | 5.5 – 9% | 0.809 | Moderate to High |

Is Relocating to the Caribbean Right for You?

Choosing the Caribbean as your family’s new home is a decision that extends beyond the allure of reduced taxes; it’s about selecting a lifestyle that aligns with your preferences and needs. Important considerations include the cost of living, healthcare quality, educational facilities for children, and the political and economic stability of your chosen locale. Each Caribbean nation offers a unique lifestyle, from the vibrant culture of Antigua & Barbuda to the tranquil beaches of the Turks & Caicos and the sophisticated financial sectors of the Cayman Islands. Finding the perfect balance between the financial benefits and the quality of life, you desire is key to making the right choice for you and your loved ones.

Conclusion

The region has seen significant improvements in livability and connectivity, making it increasingly appealing for those considering the move. Easier flight access has made these island paradises more accessible than ever, while technological advances have enabled business owners and investors to easily operate remotely. Imagine starting your day with a video conference overlooking the Caribbean Sea or managing your investments from a café with ocean views, all supported by reliable internet and modern banking services. Natural beauty, fiscal benefits, and enhanced connectivity transform the Caribbean from a mere holiday destination to a feasible, fulfilling place to live and work. As you contemplate this move, consider how well this unique leisure, opportunity, and lifestyle mix fits your dreams and professional ambitions.

Frequently Asked Questions (FAQ)

1. What are the primary considerations for individuals before relocating to a Caribbean country for tax benefits?

Before making the move, individuals should assess various factors beyond tax savings. These include understanding the legal requirements for residency or citizenship, evaluating the quality of local healthcare and education, considering the cost of living, and ensuring a stable political and economic environment. It’s also crucial to understand any implications for their tax obligations in their home country and the potential for changes in tax policies within the Caribbean nation.

2. How do Caribbean countries with low taxes attract foreign investment and what impact does this have on their economies?

Caribbean countries with low tax regimes attract foreign investment by offering a favourable environment for businesses and investors, such as minimal taxation on income, capital gains, and inheritance. This influx of investment can lead to economic growth, improved infrastructure, and job creation. However, it also raises questions about tax competition, financial transparency, and the equitable distribution of tax burdens among different population segments.

3. Are there any potential downsides to the low-tax policies of Caribbean countries for residents?

While low-tax policies can provide significant advantages for residents, especially high-net-worth individuals, they might also have downsides. For instance, relying on indirect taxes like import duties can increase the cost of goods and services. Additionally, limited tax revenues may affect the government’s ability to invest in public services and infrastructure, potentially impacting the quality of life for residents.

4. How can someone determine if they are eligible for tax benefits in a Caribbean country, and what steps should they take to apply?

Eligibility for tax benefits typically depends on residency status, source of income, and compliance with local tax laws. Interested individuals should consult a tax advisor familiar with Caribbean tax laws to understand the specific criteria and obligations. The next steps would involve applying for residency or citizenship through the proper channels, which may include investment programs, and ensuring compliance with all legal and financial requirements for relocation.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Tax Reduction, Travel, Citizenship by Investment, Second Residence, Real Estate Investing, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Living in the Caribbean, Barbados, Cayman Islands, The Bahamas, Antigua and Barbuda, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship