Overview

The St. Lucia Citizenship by Investment program offers a unique opportunity to secure a second citizenship in the Caribbean. In a recent shift within the Caribbean citizenship landscape, where the minimum investment requirement has been raised to US $200,000 by all programs except St. Lucia, this initiative maintains a competitive minimum threshold of US $100,000. This strategic positioning enhances St. Lucia’s appeal to global investors and underscores its commitment to providing accessible investment pathways. With a swift processing period of just four months, the program facilitates global mobility through a St. Lucia passport that provides visa-free access to 146 countries and positions St. Lucia as a lucrative locale for those seeking the Caribbean’s tax-free benefits and vibrant lifestyle.

This guide outlines the steps to leverage the St. Lucia Citizenship by Investment program, highlighting how straightforward it is to make the Caribbean your second home.

Benefits of St Lucia Citizenship by Investment

Visa-Free Travel

Gaining a second passport through the St Lucia Citizenship by Investment Program opens the door to Visa-Free Travel to many countries. Holders of St Lucia passports enjoy the freedom to enter 146 countries without the hassle of acquiring visas. This includes sought-after destinations like the entire Schengen zone, the United Kingdom, Hong Kong, and Singapore. Additionally, St Lucia’s strong relationship with the United States allows citizens a 10-year visa option. This is rare for passports and even affords the privilege of spending up to 6 months annually in the US. Visa-free travel facilitates spontaneous vacations, international business opportunities, and a global lifestyle that’s both rewarding and convenient.

Tax Benefits

St Lucia’s tax regime is particularly attractive to wealthy families and investors seeking to optimize their financial affairs. The Tax Benefits of St Lucia’s Citizenship by Investment Program offer immense value. Through the Saint Lucia International Business Corporation (IBC) regime, individuals and business can pay no tax on foreign-sourced income. There is also a unique opportunity to receive treaty benefits within the CARICOM region through Offshore companies. Residents are only taxed on income sourced within the country. Crucially, there’s no tax on worldwide dividends or interest income. This provides significant savings for those with international business interests. Furthermore, St Lucia does not have capital gains or inheritance taxes, enabling wealth preservation across generations.

Business Opportunities

Investors in the St Lucia Citizenship by Investment Program gain access to various Business Opportunities throughout the CARICOM economic region. There are 20 countries throughout the Caribbean, including Barbados, Jamaica, Guyana, The Bahamas, and associate members such as the Cayman Islands. St Lucia is also a member of the OECS (Organization of Eastern Caribbean States), which provides freedom for St Lucia Citizens. It allows them to live and work in several other Caribbean countries, including Antigua, Barbados, St. Kitts, and more.

As a growing economy, St Lucia offers profitable investment opportunities is tourism, agriculture, and real estate development potential. The government’s support for foreign investment is evident through streamlined processes and an encouraging entrepreneurial environment. St. Lucia is also a very popular location for wealth planning with top-tier offshore banking. Some of the banking options include CIBC Bank, Republic Bank as well as Proven Bank, a popular offshore option with locations in St Lucia and Cayman Islands.

Liveability

What St Lucia is known for is its natural beauty and diverse culture, which are influenced by strong French and British influences. Renowned for temperate weather and welcoming communities, St. Lucia is more than a vacation destination. It’s a fantastic place to call home. The island’s improving infrastructure, healthcare services, and access to amenities are better than most in the Caribbean. Several new luxury gated communities, such as Cabot Saint Lucia, enhance its Liveability. These gated communities are especially attractive for HNWI and wealthy families looking for a safe haven. From the lush rainforests to the laid-back Creole culture, life in St Lucia offers a unique blend of relaxation and vibrant living.

CARICOM Access

A St Lucia passport is a gateway into the Caribbean Community (CARICOM), an organization that promotes economic integration and cooperation among its member states. As St Lucia is a member, citizens enjoy the benefits of the CARICOM Single Market and Economy (CSME). This allows for the free movement of goods, services, people, and capital. This regional access and privileges can be a game-changer for new businesses expanding their operations across the Caribbean. For wealthy families and HNWIs, it means broader educational, work and investment opportunities for families throughout the member countries.

Requirements for St Lucia Citizenship by Investment

Investment Options

When we’re exploring how to secure St. Lucia citizenship through investment, it’s essential to understand the variety of options available. Investors can choose from several pathways, each catering to different investment preferences. First, there’s the Real Estate Investment route, which involves purchasing property within government-sanctioned projects. This choice is ideal for those who wish to maintain a tangible asset on the beautiful island. Another avenue is the Government Bond Investment, where funds are directed towards the nation’s development projects via non-interest-bearing bonds. These investments showcase a commitment to St. Lucia’s growth and future.

The third option is Business Investment, which aligns with the interests of entrepreneurs looking to contribute to the local economy. This involves injecting capital into government-approved business ventures that promise to create job opportunities for Saint Lucians. Lastly, the National Economic Fund donation is a straightforward economic contribution that supports national initiatives. This fund is pivotal in financing socioeconomic projects and is a popular choice for applicants looking for the most direct investment method.

Financial Requirements

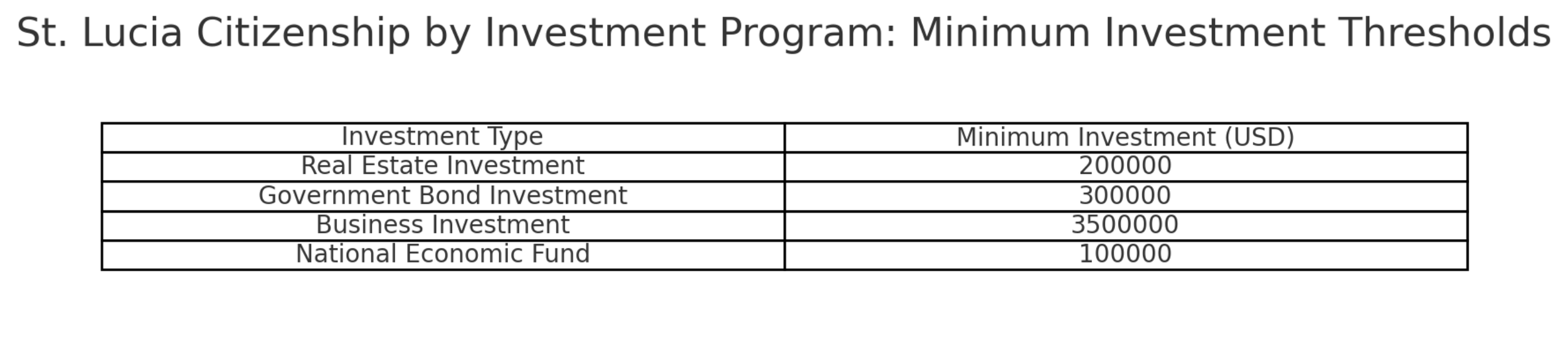

The program’s investment amounts vary based on the chosen option. St. Lucia maintains a competitive edge with its $100,000 minimum investment threshold for the National Economic Fund contribution, significantly lower than the newly established $200,000 minimum by other Caribbean programs.

Notably, these amounts exclude additional fees such as Due Diligence charges, Professional fees, and other associated costs. Our advice always includes a comprehensive financial breakdown, ensuring investors fully know the capital outlay required for their specific circumstances.

Background Checks

Trust and integrity are paramount in the St. Lucia Citizenship by Investment program. Over the years, unlike many other Caribbean Citizenship by Investment programs, St Lucia has retained a pristine reputation in the industry. This is due to their thorough, rigorous due diligence process and strong relationship with regional and global stakeholders. This is a hallmark and a non-negotiable component of the process. Applicants and their families are meticulously vetted through stringent Background Checks to uphold the program’s prestigious reputation. This involves thoroughly scrutinizing personal information, financial history, and criminal records to ensure that only reputable individuals gain citizenship.

Application Process for St Lucia Citizenship by Investment

Preparing the Application

When we begin the journey toward St Lucia citizenship by investment, a meticulous approach to preparing the application is essential. We must gather all necessary documents, including proof of identity, financial records, and a detailed background check. St Lucia’s Citizenship by Investment Program requires consultation with authorized agents, the only ones permitted to submit applications. These experienced agents help us navigate the paperwork, ensuring every box is ticked, and they conduct preliminary due diligence. This sets the foundation for a smooth process ahead for our clients.

Submitting the Application

Once we have all our documents in order, we submit them to our chosen licensed agent. It’s their task to carefully review our application, ensuring it meets the stringent standards set by the St Lucia Citizenship by Investment Program. The program, known for its efficient process, demands that the submission is done correctly and promptly. Our application and due diligence fee are sent to the Citizenship by Investment Unit (CBIU) of St Lucia. As we commit to this step, we’re on the verge of unlocking significant global mobility, as St Lucia’s passport allows visa-free or visa-on-arrival access to over 140 destinations globally.

Processing Time

In 2023, the Government of St Lucia completely revamped the CIP processing protocol. They swiftly introduced a pre-processing module that significantly cut the waiting period. The average processing time for acquiring citizenship now stands at an impressive 45 days, provided the documents are pre-cleared through law enforcement background checks. This streamlined process, from the initial submission to receiving the passport, usually takes about 3 to 4 months.

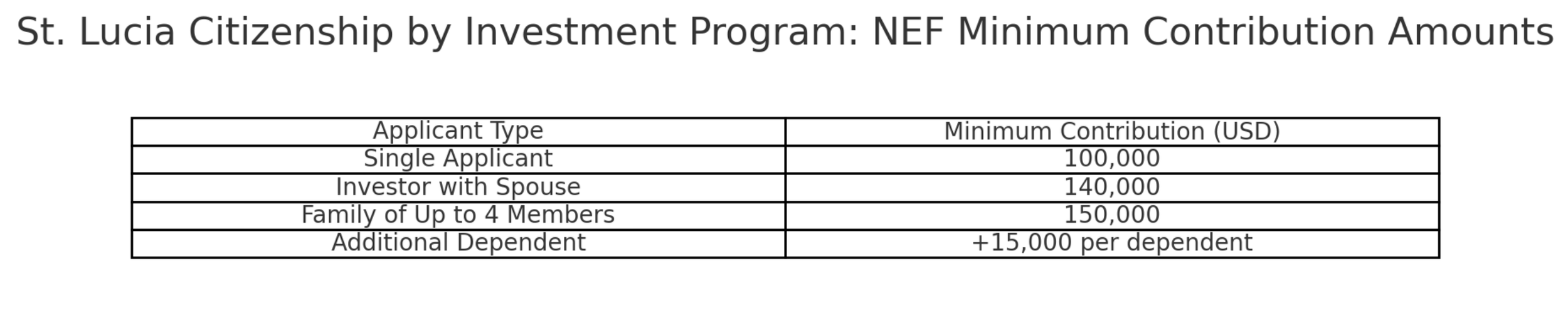

Here is a simple breakdown of the minimum contribution amounts for the National Economic Fund (NEF) under St Lucia’s Citizenship by Investment Program:

Remember, these figures reflect current time-limited offers, showing the program’s adaptability and responsiveness to applicant needs. We should also consider the five-year holding period for real estate investments, currently at a minimum of $300,000. This commitment reinforces our belief in the long-term value of St Lucia’s economic landscape.

Investment Options for St Lucia Citizenship

Choosing the right investment route is crucial when looking to participate the St. Lucia Citizenship by Investment program. The program offers various options, each designed to facilitate a smooth path to citizenship. Investors should weigh their preferences and financial goals when selecting from available options.

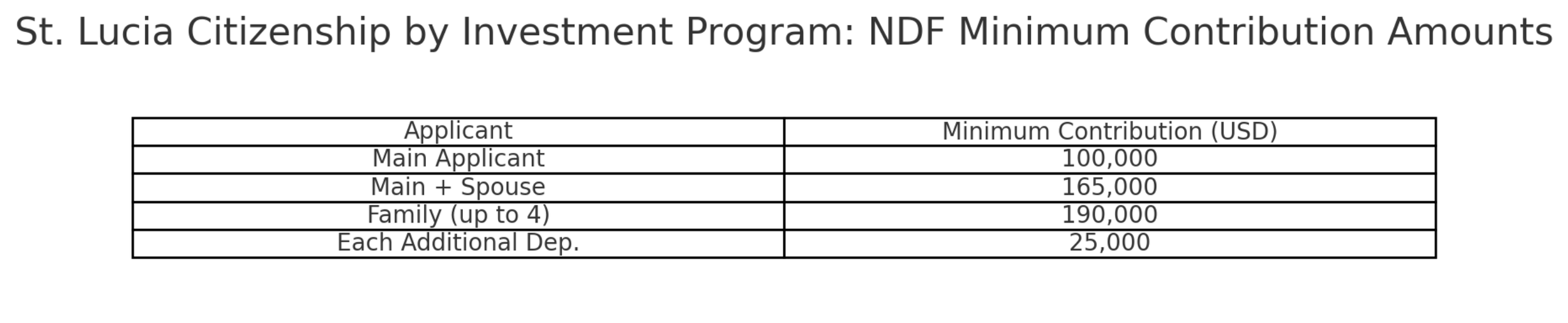

National Development Fund

The National Development Fund (NDF) is a foundational investment option under the St Lucia Citizenship by Investment program. It entails a one-time non-refundable contribution which starts at USD 100,000 for a single applicant. This straightforward route is often selected for its simplicity and swift processing. The NDF supports various national projects, from education to infrastructure, aligning investors’ contributions with St. Lucia’s developmental goals.

Funds contributed to the NDF bolster St. Lucia’s growth, and investors can take pride in knowing they are making a difference while securing their future.

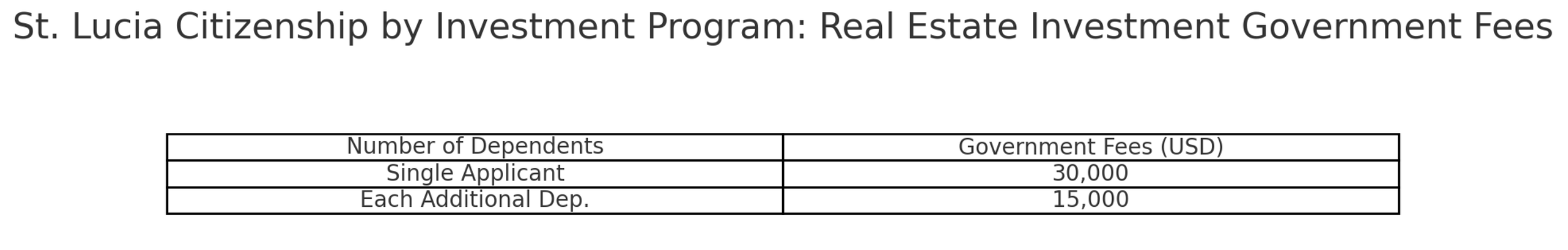

Real Estate Investment

Real estate investing is another popular choice within the St Lucia Citizenship by Investment program. To qualify, investors must allocate a minimum of USD 200,000 in approved real estate projects. This investment must be maintained for at least five years before it can be resold. Such projects usually span luxurious resorts or high-end residential developments, promising not only a potential return on investment but also the luxury of owning property in a tropical paradise.

Real estate investments bear additional government fees, and applicants should be prepared for these:

Real estate investment serves as an asset and a gateway to citizenship, allowing a diverse portfolio expansion.

Business Investment

For those with an entrepreneurial spirit, the Business Investment route provides an opportunity to foster economic growth within local sectors. Individuals must invest at least USD 3.5 million in authorized business projects, creating at least three permanent jobs. Alternatively, joint ventures are available, requiring a combined investment of USD 6 million from at least two applicants and creating at least six permanent jobs.

This option taps into the island’s burgeoning markets, offering investors a chance to play an active role in St. Lucia’s economic fabric. A business investment secures citizenship and positions investors at the forefront of the island nation’s development and prosperity.

The St. Lucia Citizenship by Investment program stands out with these tailored investment options. All while ensuring that every investor finds a suitable and effective path to obtaining their new citizenship. Whether through contributing to the island’s development via the NDF, or investing in tangible assets like real estate, investors are provided with options to secure their future and that of their families.

Conclusion

Securing St. Lucia citizenship through investment offers a wealth of opportunities for families, from increased mobility with visa-free travel to many countries to potential tax advantages. Whether we contribute to the National Development Fund to support real estate ventures or invest in a business, the process is designed to be straightforward and beneficial. By selecting the option that aligns with our financial goals and lifestyle preferences, we’re not just investing in a second passport—we’re investing in our future.

Frequently Asked Questions (FAQ)

1. What makes St. Lucia’s Citizenship by Investment Program unique compared to other Caribbean programs?

St. Lucia’s Citizenship by Investment Program is distinguished by its various investment options. It has a low minimum investment threshold of US $100,000 and a swift processing time of approximately four months. Additionally, the program grants visa-free access to 146 countries and offers attractive tax benefits, positioning St. Lucia as a premier destination for investors seeking global mobility and financial growth.

2. Can my family also obtain citizenship through my investment, and if so, what are the requirements?

Yes, your family can obtain citizenship through your investment. The program includes dependents, such as spouses, children under 30, and parents or grandparents over 55, provided the main applicant fully supports them. Each dependent adds to the investment amount and due diligence fees, so it’s important to consult with an authorized agent for a comprehensive financial breakdown.

3. Are there any annual taxes for citizens who do not reside in St. Lucia?

St. Lucia offers a favourable tax regime; non-resident citizens are not taxed on worldwide income, dividends, or interest. Taxes are only levied on income sourced within St. Lucia. This makes it an attractive option for investors seeking to optimize their tax liabilities while enjoying the benefits of a second citizenship.

4. What are the due diligence and processing fees associated with the St. Lucia Citizenship by Investment Program?

Additional applicants must pay due diligence fees. This can range from $7,500 for the main applicant to $5,000 for a spouse and $2,000 for each dependent over 16. This doesn’t include processing fees. The total cost varies depending on the investment option and the number of family members included in the application. Consult with an authorized agent for a detailed cost breakdown.

5. How long does the citizenship last, and can it be revoked?

Once granted, St. Lucia citizenship is permanent and can be passed down to future generations. However, it can be revoked if the citizen does not adhere to the laws of St. Lucia or if the citizenship was obtained through false representation or fraud. This underscores the importance of providing accurate information and complying with all legal requirements during the application process.

6. Can I sell my investment after obtaining citizenship, and if so, when?

Yes, investments made under the real estate option can be sold after a minimum holding period of five years. This allows investors to recoup their investment while potentially retaining their citizenship. For the National Economic Fund option, the contribution is non-refundable. The government bond option typically requires holding the investment for five years before it can be liquidated. Reviewing the specific terms and conditions associated with each investment option is essential to fully understanding the requirements.

Learn More

Offshore Freedom™ is a boutique coaching and consulting firm that helps investors and entrepreneurs live and invest internationally. We help our clients grow their businesses, pay less taxes, buy more real estate, and take advantage of global residency and citizenship by investment programs worldwide.

Schedule a 1 on 1 consultation with Dan Merriam, and let us help you design the life of your dreams and live the Offshore Freedom™ lifestyle. Ask questions and get answers about international real estate, tax planning, offshore banking, second residencies, citizenship by investment, lifestyle design and more.

This article is for informational purposes only; it should not be considered financial, tax planning, investment or legal advice. Consult a certified financial or investment professional in your jurisdiction of interest before making any major financial or investment decisions.

Writer in Tax Reduction, International Tax Planning, Travel, St Lucia Citizenship by Investment, Caribbean, St Lucia Citizenship, St Lucia Real Estate, Cabot St Lucia, CARICOM, Second Residence, Real Estate Investing, Asset Management, Lifestyle Planning, Countries with the Lowest Taxes, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship